DRS: Draft registration statement submitted by Emerging Growth Company under Securities Act Section 6(e) or by Foreign Private Issuer under Division of Corporation Finance policy

Published on August 30, 2024

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

As submitted confidentially with the U.S. Securities and Exchange Commission on August 30, 2024. This draft registration statement has not been publicly filed with the U.S. Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Viking Holdings Ltd

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrants name into English)

| Bermuda | 4400 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

94 Pitts Bay Road

Pembroke, Bermuda HM 08

Tel: (441) 478-2244

(Address, including zip code, and telephone number, including area code, of Registrants principal executive offices)

Leah Talactac

Chief Financial Officer

5700 Canoga Avenue

Woodland Hills, CA 91367

Tel: (818) 227-1234

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Jonathon Jackson Brett Nadritch Iliana Ongun Milbank LLP 55 Hudson Yards New York, NY 10001-2163 Tel: (212) 530-5000 |

Christopher D. Lueking Scott W. Westhoff Jonathan E. Sarna Latham & Watkins LLP 330 N. Wabash Avenue, Suite 2800 Chicago, IL 60611 Tel: (312) 876-7700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

The information in this preliminary prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, and neither we nor the selling shareholders are soliciting an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated , 2024

PRELIMINARY PROSPECTUS

Viking Holdings Ltd

Ordinary Shares

The selling shareholders identified in this prospectus are offering an aggregate of ordinary shares. The underwriters may also purchase up to ordinary shares from the selling shareholders within 30 days of the date of this prospectus. We will not receive any proceeds from the sale of ordinary shares by the selling shareholders. Our ordinary shares are listed on the New York Stock Exchange (NYSE) under the symbol VIK. On , 2024, the last reported share price of our ordinary shares as reported on the NYSE, was $ per share.

We have two classes of shares: ordinary shares and special shares. The rights of the holders of our ordinary shares and our special shares are identical, except with respect to voting, conversion and transfer rights. Each ordinary share is entitled to one vote per share and each special share is entitled to 10 votes per share. Each special share may be converted at any time into one ordinary share at the option of the holder and will convert automatically into one ordinary share upon transfer, subject to certain exceptions. See Description of Share Capital. As a result of its ownership of special shares, our principal shareholder (as defined herein) holds approximately 87% of the voting power of our issued and outstanding share capital. As a result of our principal shareholders ownership, we are a controlled company within the meaning of the rules of the NYSE and are permitted to rely on certain of the controlled company exemptions under the NYSE corporate governance rules.

Investing in our ordinary shares involves risks. See Risk Factors on page 37.

We are a foreign private issuer under applicable Securities and Exchange Commission rules and are eligible for reduced public company disclosure requirements. See Prospectus SummaryImplications of Being a Foreign Private Issuer.

| Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds, Before Expenses, to the Selling Shareholders |

||||||||||

| Per Ordinary Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See Underwriting for additional information regarding underwriting compensation. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The selling shareholders have granted to the underwriters a 30-day option to purchase up to additional ordinary shares from the selling shareholders at the public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the ordinary shares on or about , 2024.

(in alphabetical order)

| BofA Securities | J.P. Morgan |

The date of this prospectus is , 2024.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

ONE BRAND

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

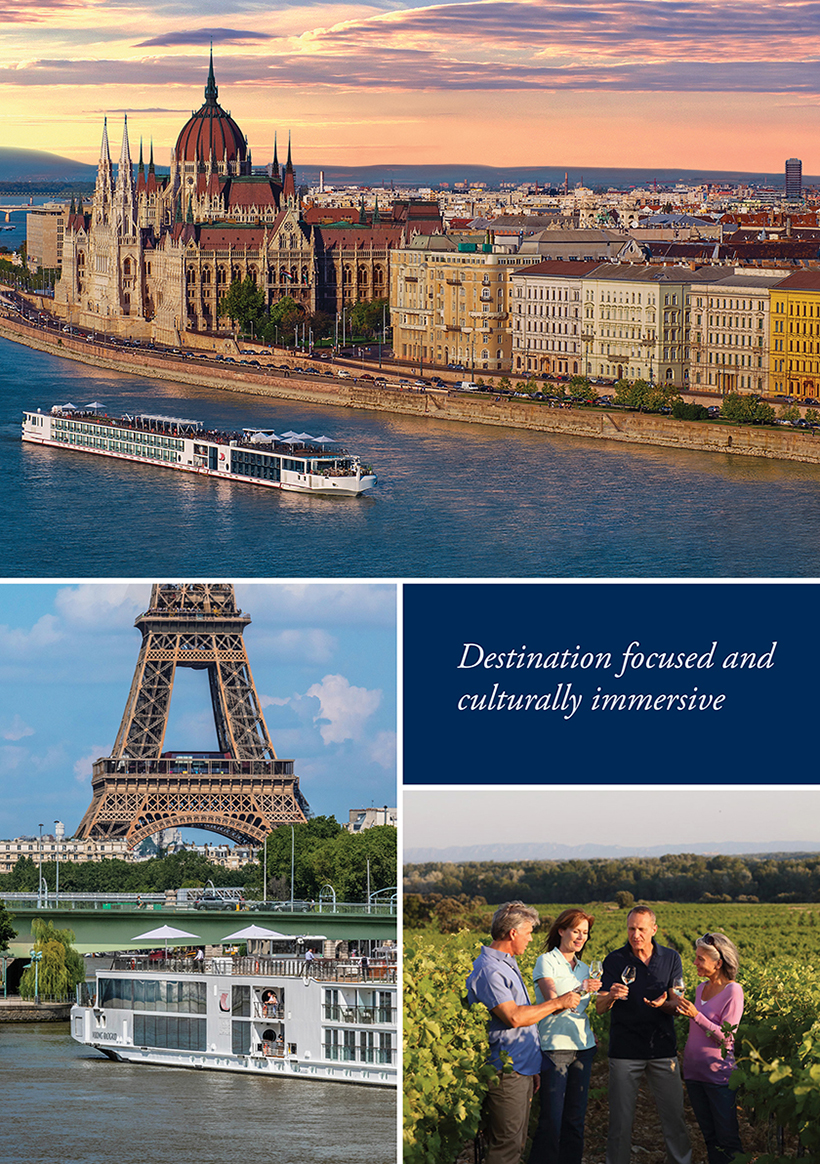

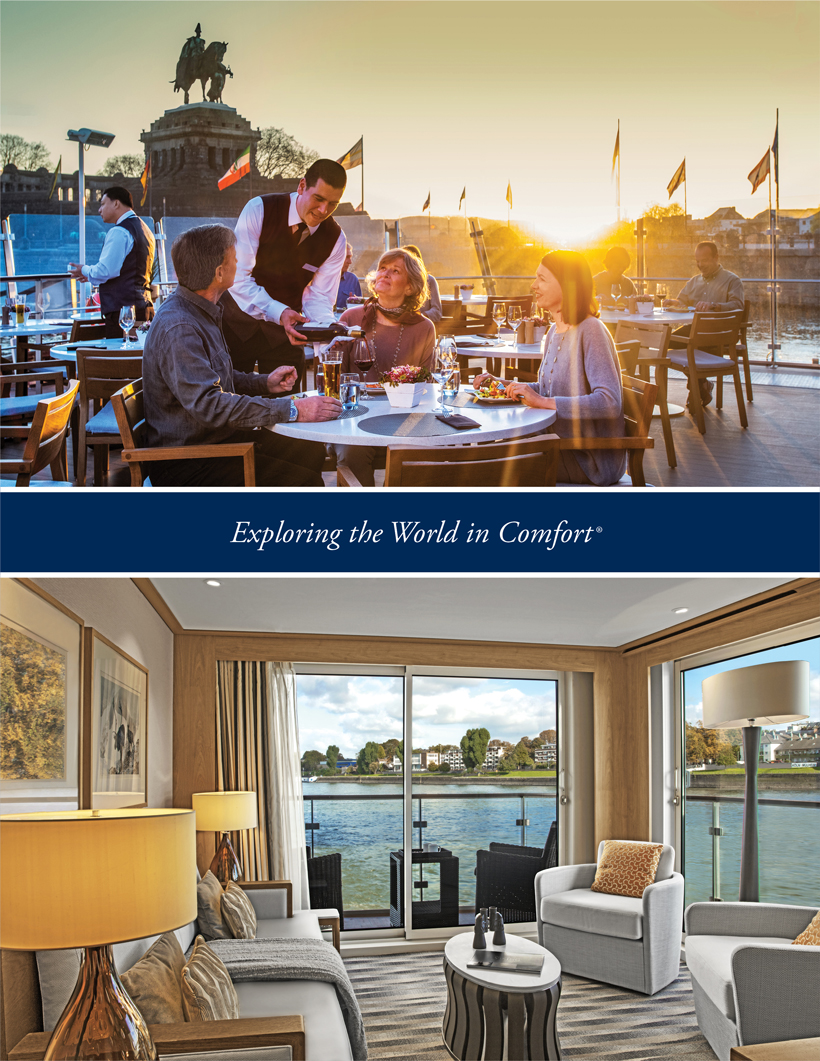

Destination focused and culturally immersive

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Viking By the Numbers 93 vessels 650,000 guests 2023,51# Returning $4.7 billion 2023 Total revenue 14.4% 2015-2023 total revenue cagr 10,000+ employees from 90+countries

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

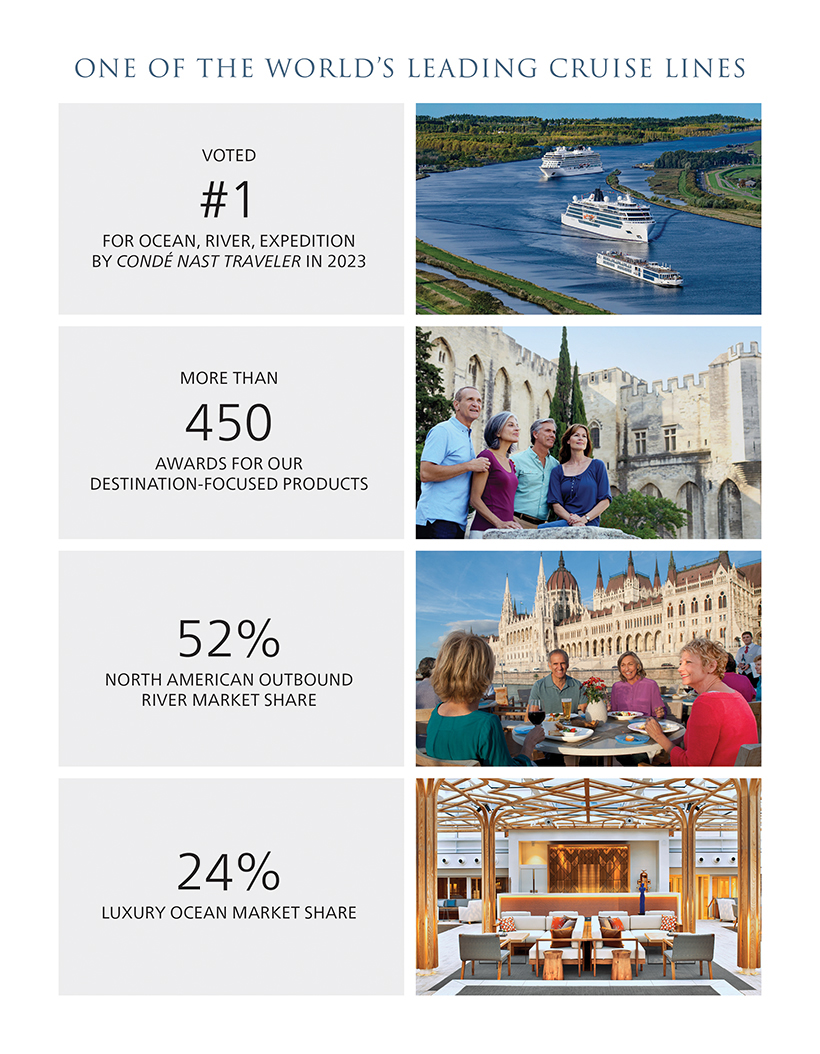

One of the world's leading cruise lines

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

| 1 | ||||

| PRESENTATION OF FINANCIAL INFORMATION AND CERTAIN DEFINITIONS |

1 | |||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 26 | ||||

| 28 | ||||

| 37 | ||||

| 72 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

77 | |||

| 105 |

| 107 | ||||

| 140 | ||||

| 150 | ||||

| 152 | ||||

| 155 | ||||

| 168 | ||||

| 170 | ||||

| 173 | ||||

| 181 | ||||

| 182 | ||||

| 182 | ||||

| 183 | ||||

| 184 | ||||

| F-1 |

Neither we, the selling shareholders nor the underwriters have authorized anyone to provide you with any information or make any representation other than the information contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We, the selling shareholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any information other than the information in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of ordinary shares. Our business, financial condition and results of operations may have changed since the date on the cover page of this prospectus. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. We will make copies of this prospectus available to the selling shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act of 1933 (the Securities Act).

For investors outside the United States: Neither we, the selling shareholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

i

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

As used in this prospectus, unless the context otherwise requires, references to we, us, our, our business, the Company, Viking and similar references refer to Viking Holdings Ltd and, where appropriate, its consolidated subsidiaries.

PRESENTATION OF FINANCIAL INFORMATION AND CERTAIN DEFINITIONS

Presentation of Financial Information

Our audited consolidated financial statements as of December 31, 2022 and 2023 and for the years ended December 31, 2021, 2022 and 2023 included in this prospectus have been prepared in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB). The summary consolidated financial information as of December 31, 2019, 2020 and 2021 and for the years ended December 31, 2019 and 2020 has been derived from our consolidated financial statements that are not included in this prospectus.

Our unaudited interim condensed consolidated financial statements as of June 30, 2024 and for the six months ended June 30, 2023 and 2024 included in this prospectus have been prepared in accordance with IFRS, as issued by IASB. The unaudited interim condensed consolidated financial statements as of June 30, 2024 and for the six months ended June 30, 2023 and 2024 included in this prospectus are unaudited, and all information contained in this prospectus with respect to such periods is also unaudited.

We have made rounding adjustments to reach some of the figures included in this prospectus. As a result, numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them.

In this prospectus, unless otherwise indicated, all references to U.S. dollars, dollars or $ are to the lawful currency of the United States of America and all references to euro or are to the lawful currency of the participating Member States in the Third Stage of European Economic and Monetary Union of the Treaty Establishing the European Community, as amended from time to time.

Presentation of Other Data and Certain Definitions

Unless otherwise specified or the context requires otherwise in this prospectus, all references to:

| | 2024 season to date are to the period from January 1, 2024 through end of July or early August 2024, as available; |

| | Adjusted EBITDA are to EBITDA (consolidated net income (loss) adjusted for interest income, interest expense, income tax benefit (expense) and depreciation, amortization and impairment) as further adjusted for non-cash Private Placement derivatives gains and losses, loss on Private Placement refinancing, currency gains or losses, stock-based compensation expense and other financial income (loss) (which includes forward gains and losses, gain or loss on disposition of assets, certain non-cash fair value adjustments, restructuring charges and non-recurring items); |

| | Adjusted EBITDA Margin are to the ratio, expressed as a percentage, of Adjusted EBITDA divided by Adjusted Gross Margin; |

| | Adjusted FCF Conversion are to the ratio, expressed as a percentage, of Adjusted FCF divided by Adjusted EBITDA; |

| | Adjusted Free Cash Flow or Adjusted FCF are to net cash flow from (used in) operating activities as adjusted for interest paid, interest payments for lease liabilities, interest received, and Ongoing Capex, as further adjusted for cash portion of interest expense related to our Series C Preference Shares. Our Series C Preference Shares automatically converted into ordinary shares immediately prior to the consummation of our IPO; |

1

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

| | Adjusted Gross Margin are to gross margin adjusted for vessel operating expenses and ship depreciation and impairment. Gross margin is calculated pursuant to IFRS as total revenue less total cruise operating expenses and ship depreciation and impairment; |

| | Advance Bookings are to the aggregate ticketed amount for guest bookings for our voyages at a specific point in time, and include bookings for cruises, land extensions and air; |

| | average age are, for ships or vessels, to average age of those ships or vessels weighted by berth; |

| | berth are to a space for one passenger. Almost all of our staterooms are double occupancy, or two berth staterooms, but we have some staterooms that are single occupancy, or single berth staterooms; |

| | CAGR are to compound annual growth rate; |

| | Capacity Passenger Cruise Days or Capacity PCDs, with respect to any given period, are to measurements of capacity that represent, for each ship operating during the relevant period, the number of berths multiplied by the number of Ship Operating Days, determined on an aggregated basis for all ships in operation during the relevant period; |

| | China JV Investment are to the joint venture between us and China Merchants Shekou, a subsidiary of China Merchants Group, to build a cruise line offering Chinese coastal sailing for Mandarin-speaking populations in China. The China JV Investment is primarily operated by CMV, in which we have a 10% interest; |

| | China Outbound are to our outbound river cruise product marketed to Mandarin-speaking passengers. China Outbound is separate from the China JV Investment and wholly owned by us; |

| | CMV are to China Merchants Viking Cruises Limited, the entity of the China JV Investment that operates the China JV Investments first ship, the Zhao Shang Yi Dun; |

| | direct in relationship to the sales distribution channel are to passengers who purchased their cruise packages directly from us; |

| | guest quality ratings are to a metric that represents the average response provided by our guests when completing the onboard surveys provided in staterooms on each voyage (one per guest). These responses are collected on a 4-level scale, with 1 Poor, 2 Fair, 3 Good, and 4 Great; |

| | Invested Capital are to the average of the most recent four quarters of indebtedness, gross of loan fees, less cash and cash equivalents, plus total shareholders equity; |

| | IPO are to the Companys initial public offering that closed on May 3, 2024; |

| | large public cruise lines are to Carnival Corporation, Norwegian Cruise Line Holdings Ltd. and Royal Caribbean Cruises Ltd.; |

| | Net Promoter Score are to a metric that helps companies measure customer loyalty and that predicts overall company growth. Net Promoter Scores are measured through customer response to a single question on how likely they are to recommend the product or service to others and are reported with a number that ranges from -100 to +100. A higher score is more desirable, and score ranges tend to vary by industry. Vikings score is calculated by asking guests, How likely are you to recommend Viking Cruises to a friend? on a 0 to 10 scale. Percent 9 to 10 is calculated (as promoters), percent 7 to 8 is ignored (passives) and percent 0 to 6 (detractors) is calculated and subtracted from the percent of 9 to 10 scores. This results in a composite measure of share of promoters less share of detractors; |

| | Net Yield are to Adjusted Gross Margin divided by Passenger Cruise Days; |

| | NM are to certain metrics that were not meaningful and as such were excluded, including due to the impact of the novel coronavirus (COVID-19); |

| | North America and North American are to the United States of America and Canada; |

2

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

| | Occupancy are to the ratio, expressed as a percentage, of Passenger Cruise Days to Capacity Passenger Cruise Days with respect to any given period. Contrary to many of our competitors, we do not allow more than two passengers to occupy a two-berth stateroom. Additionally, we have guests who choose to travel alone and are willing to pay higher prices for single occupancy in a two-berth stateroom. As a result, our Occupancy cannot exceed 100%, and may be less than 100%, even if all our staterooms are booked; |

| | Ongoing Capex are to investments in property, plant and equipment and intangible assets (PP&E), adjusted to exclude additions to PP&E for vessels and ships under construction and additions to PP&E for vessels and ships delivered in the relevant period; |

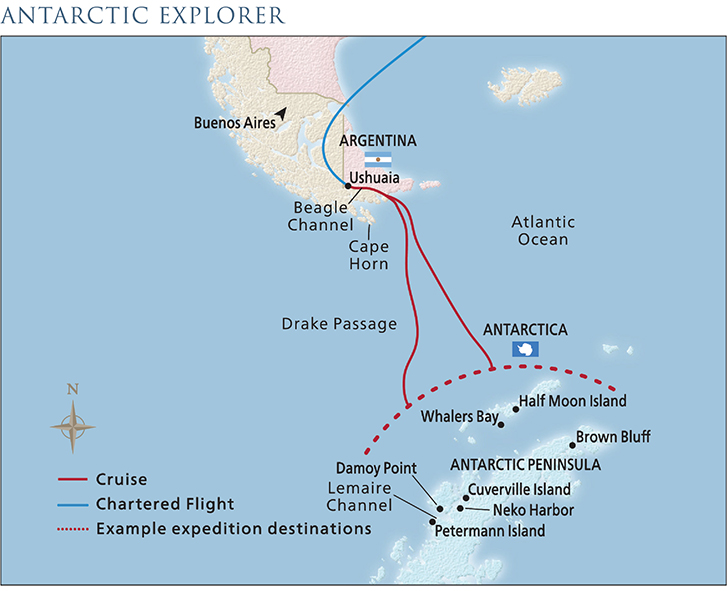

| | our Antarctic expedition market share are to our share of passenger volume for all expedition vessels that carried guests to Antarctica, where passenger volume is defined as the total number of passengers carried on non-governmental expeditions on ships which could land on shore for the 2023 season, as reported to the Secretariat of the Antarctic Treaty Electronic Information Exchange System. The Antarctic season spans from the fourth quarter of a calendar year to the first quarter of the following calendar year; |

| | our core products are to Viking River, Viking Ocean, Viking Expedition and Viking Mississippi; |

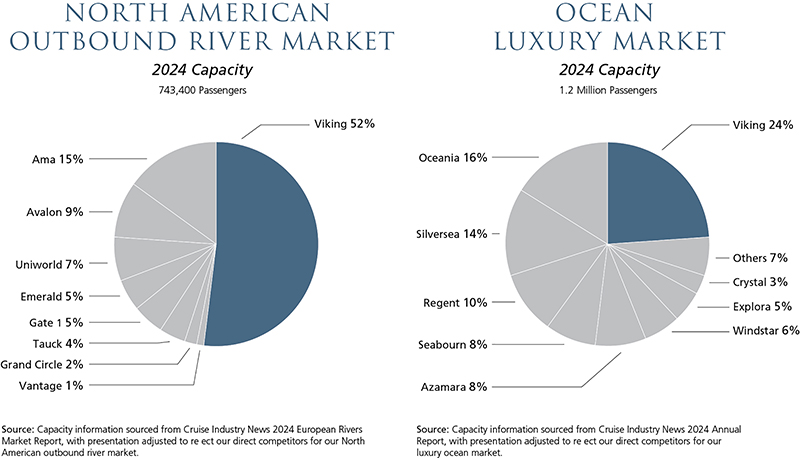

| | our luxury ocean market share are to our share of capacity passengers of all ships operated by luxury ocean cruise lines (Atlas Ocean Voyages, Crystal Cruises, Emerald Cruises, Explora Journeys, Paul Gauguin Cruises, Regent Seven Seas Cruises, The Ritz-Carlton Yacht Collection, Scenic Luxury Cruises & Tours, Seabourn Cruise Line, SeaDream Yacht Club, Silversea Cruises and Windstar Cruises), and select small / medium size premium cruise lines that we consider direct competitors (Azamara and Oceania Cruises) for 2024, which is sourced from Cruise Industry News, where capacity passengers is defined as the total number of passengers a ship can carry at 100% occupancy during a given time period, measured by sailing. Ocean cruise line passenger estimates include passengers on ships used for expedition cruises. As a result, our ocean market share includes our expedition ships; |

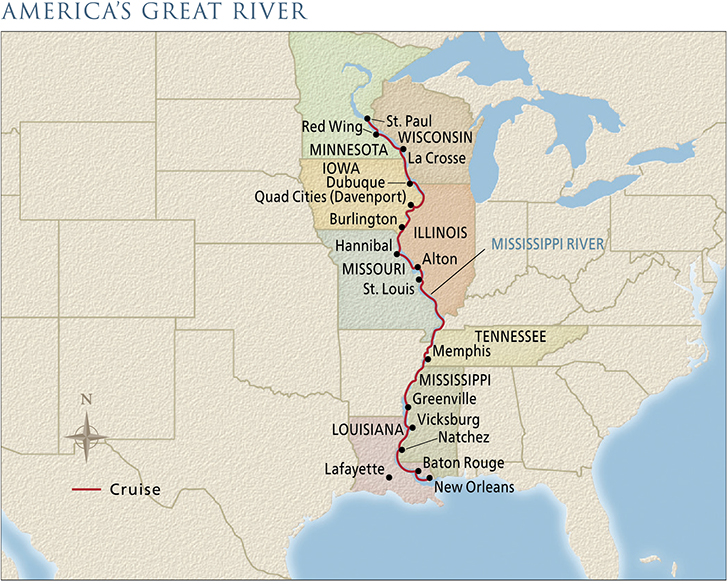

| | our Mississippi river market share are to our share of capacity passengers of ships that primarily service passengers on the Mississippi and Ohio rivers (American Cruise Lines and American Queen Voyages) for 2023, which is sourced from Cruise Industry News, where capacity passengers is defined as the total number of passengers a ship can carry at 100% occupancy during a given time period, measured by sailing; |

| | our North American outbound river market share are to our share of capacity passengers of vessels that primarily service North American passengers on European waterways (AMA Waterways, Inc., Avalon Waterways, Emerald Cruises, Gate 1 Travel, Grand Circle Travel Corp., Tauck, Uniworld River Cruises, Inc., and Vantage Travel Service, Inc.) for 2024, which is sourced from Cruise Industry News, where capacity passengers is defined as the total number of passengers a ship can carry at 100% occupancy during a given time period, measured by sailing; |

| | our primary source markets mean North America, the United Kingdom, Australia and New Zealand; |

| | outbound travel market are to the market of customers traveling internationally out of a particular country or continent; |

| | Passenger Cruise Days or PCDs are to the number of passengers carried for each cruise, with respect to any given period and for each ship operating during the relevant period, multiplied by the number of Ship Operating Days; |

| | pre- and post-trip cruise extension are to extensions available pre- and post-cruise. We also refer to our pre- and post-trip cruise extensions as land excursions; |

| | Premium Cruise Voucher are to vouchers generally with a face value of up to 125% of monies paid that we issued to guests when we cancelled sailings. Guests have generally had the option to receive |

3

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

| either a refund in cash for 100% of monies paid or a Premium Cruise Voucher. Premium Cruise Vouchers can generally be applied to a new booking for up to two years from the voucher issuance date (or longer, if the expiration date is extended) and any unused Premium Cruise Vouchers are refundable for the original amount paid upon expiration; |

| | repeat guest percentage are, for any season, the percentage of North American passengers for that season who had traveled with us before; |

| | Return on Invested Capital or ROIC are to the ratio, expressed as a percentage, of operating income (loss) adjusted for income tax (expense) benefit divided by Invested Capital; |

| | Risk Free Vouchers are to vouchers issued under temporarily updated cancellation policies in response to the COVID-19 pandemic or other events creating travel uncertainty. Under these policies, guests who cancel their cruise have the option to receive Risk Free Vouchers instead of incurring cancellation penalties. Risk Free Vouchers can generally be applied to a new booking for up to two years from the voucher issuance date but are not refundable for cash; |

| | season are to the respective calendar year for such season. For example, the 2023 season refers to the 2023 calendar year; |

| | Ship Operating Days are to the number of days within any given period that a ship is in service and carrying cruise passengers, determined on an aggregated basis for all ships in operation during the relevant period; |

| | shore excursions are to excursions provided at our destinations during a cruise itinerary; |

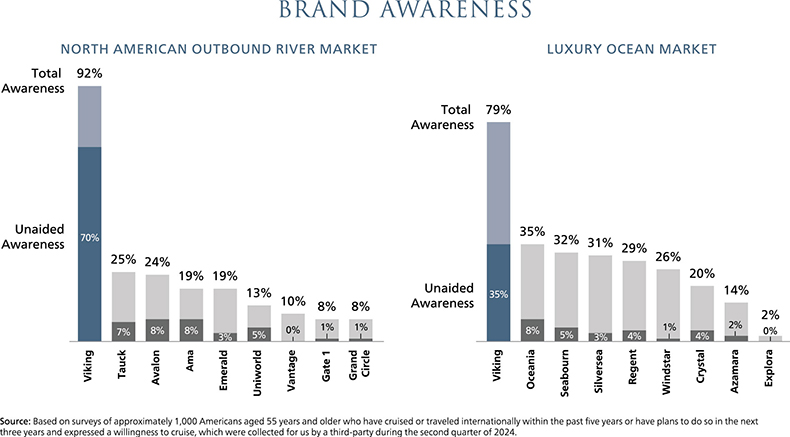

| | total brand awareness are to the percentage of survey respondents who expressed knowledge of a specific brand when asked about that brand by name or when asked about general awareness of river cruising or ocean cruising brands, as applicable, which is calculated based on surveys of approximately 1,000 Americans aged 55 years and older who have cruised or traveled internationally within the past 5 years or have plans to do so in the next 3 years and expressed a willingness to cruise. These brand awareness surveys are collected for us by a third-party, with results reported periodically; |

| | Total Debt are to indebtedness outstanding, gross of loan fees, excluding lease liabilities, Private Placement liabilities and Private Placement derivatives; |

| | VCL are to Viking Cruises Ltd, our direct wholly owned subsidiary; |

| | Viking China are to our China Outbound product and the China JV; |

| | Viking Expedition are to our expedition cruise product marketed to our primary source markets; |

| | Viking Mississippi are to the river cruise product for cruising the Mississippi River marketed to our primary source markets; |

| | Viking Ocean are to our ocean cruise product marketed to our primary source markets; and |

| | Viking River are to our river cruise product marketed to our primary source markets. Viking Mississippi is a separate product from Viking River. |

4

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

We have proprietary rights to trademarks used in this prospectus that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this prospectus is the property of its respective holder.

5

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

We obtained the industry, market and competitive position data used throughout this prospectus from internal company surveys and management estimates, as well as from industry and general publications and research, surveys and studies conducted by third parties. We believe these internal company surveys and management estimates are reliable; however, no independent sources have verified such surveys and estimates. Third-party industry and general publications, research, studies and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Except for the total brand awareness information contained herein, none of the independent industry and general publications, research, studies and surveys relied upon by us or otherwise referred to in this prospectus were prepared on our behalf. While we believe the industry, market and competitive position data included in this prospectus are reliable and are based on reasonable assumptions, these data involve many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information.

Certain estimates of market opportunity, forecasts or market growth and other forward-looking information included elsewhere in this prospectus involve risks and uncertainties and are subject to change based on various factors, including those discussed under Prospectus Summary, Risk Factors, Special Note Regarding Forward-Looking Statements and Managements Discussion and Analysis of Financial Condition and Results of Operations.

6

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Consent under the Exchange Control Act 1972 (and its related regulations) has been received. We have received consent under the Exchange Control Act 1972 (and its related regulations) from the Bermuda Monetary Authority for the issue and transfer of our securities to and between non-residents of Bermuda for exchange control purposes provided our ordinary shares remain listed on an appointed stock exchange, which includes the NYSE.

Pursuant to section 26 of the Companies Act 1981 of Bermuda (the Companies Act), there is no requirement for us to comply with Part IIIProspectuses and Public Offersof the Companies Act or to file this prospectus with the Registrar of Companies in Bermuda. Neither the Bermuda Monetary Authority, the Registrar of Companies of Bermuda nor any other relevant Bermuda authority or government body accept any responsibility for the financial soundness of any proposal or for the correctness of any of the statements made or opinions expressed in this prospectus.

7

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our ordinary shares, you should read this entire prospectus carefully, including the sections of this prospectus titled Risk Factors, Special Note Regarding Forward-Looking Statements and Managements Discussion and Analysis of Financial Condition and Results of Operations and our financial statements included elsewhere in this prospectus.

BACKGROUND

Viking was founded in 1997 with four river vessels and a simple vision that travel could be more destination-focused and culturally immersive.

Today, we have grown into one of the worlds leading travel companies, with a fleet of 93 small, state-of-the-art ships, which we view as floating hotels. From our iconic journeys on the worlds great rivers, including our new Mississippi River itineraries, to our ocean voyages around the globe and our extraordinary expeditions to the ends of the earth, we offer meaningful travel experiences on all seven continents in all three categories of the cruise industryriver, ocean and expedition cruising.

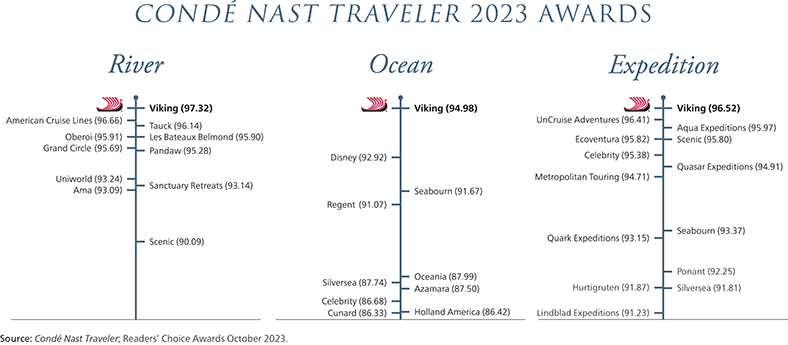

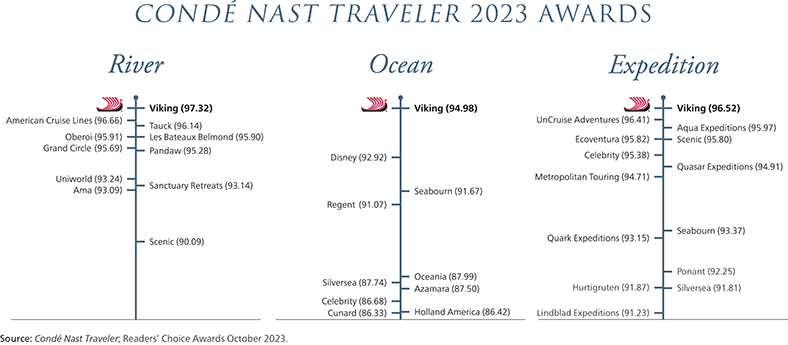

With more than 450 awards to our name, we are a leader in the industry and were rated #1 for Rivers, #1 for Oceans (for ships sized 500 to 2,500 berths) and #1 for Expeditions by Condé Nast Traveler in the 2023 Readers Choice Awards. This is the first time a travel company has been voted #1 in all three categories simultaneously.

8

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

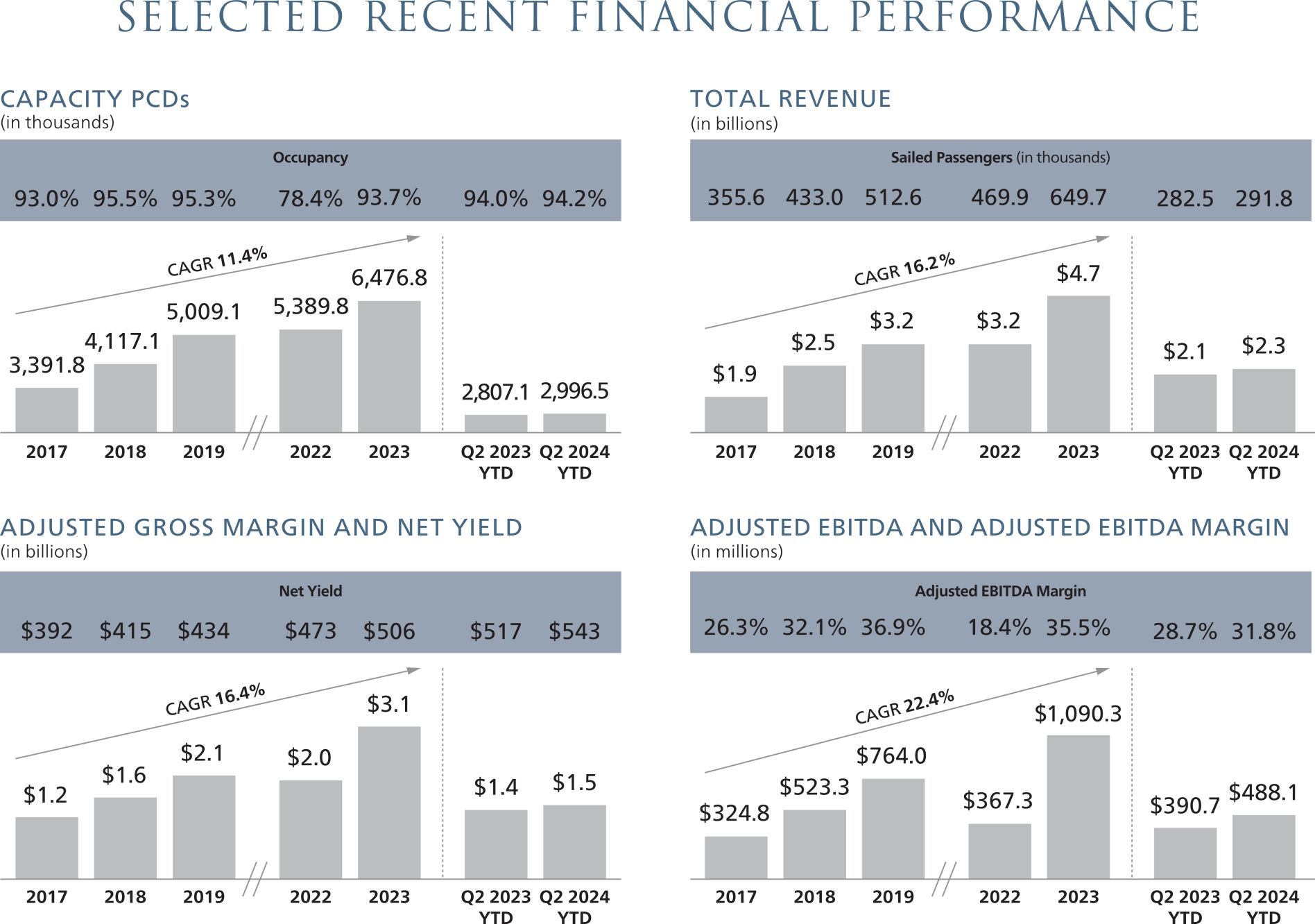

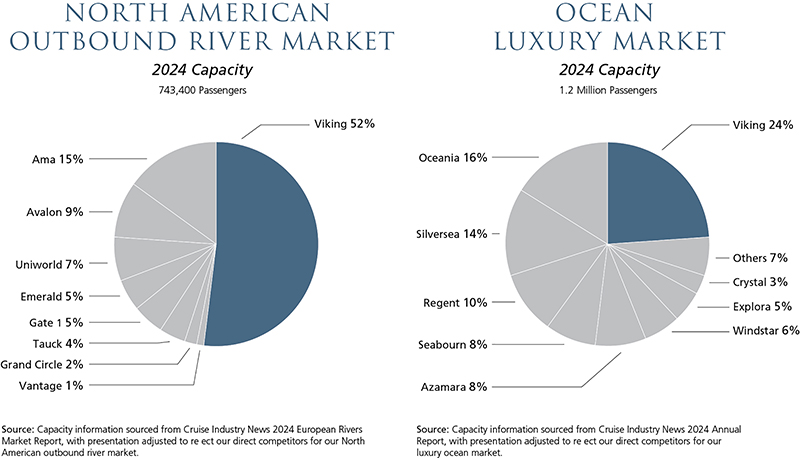

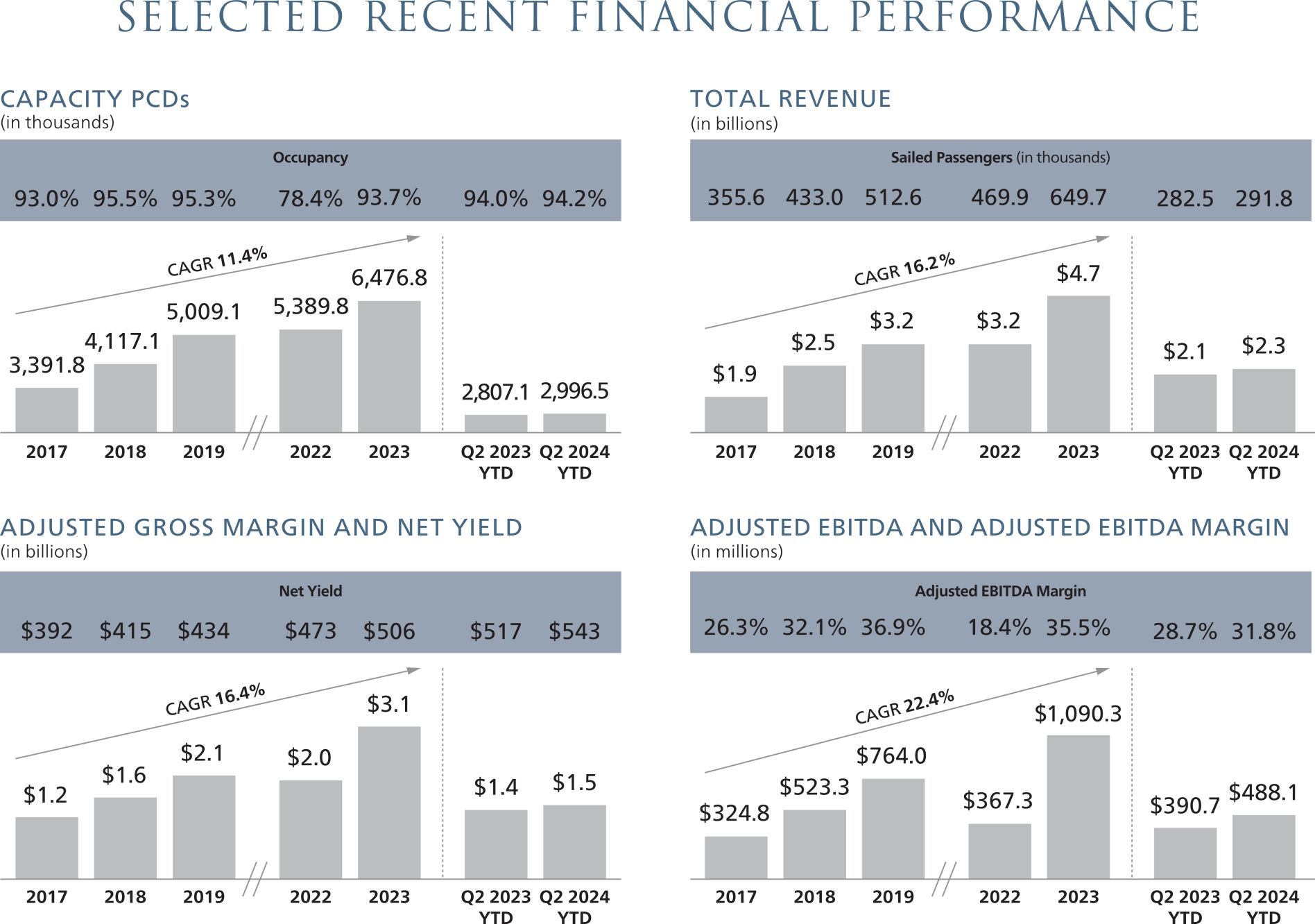

We have generated rapid growth driven by strong demand for our products and a highly differentiated guest experience, resulting in industry-leading capacity growth and the proven ability to expand our travel platform with new destinations and experiences. From 2015 to 2023, our total number of guests, total revenue, net income and Adjusted EBITDA grew at CAGRs of 10.1%, 14.4%, NM and 16.3%, respectively. We have grown faster than the overall cruise industry since 2015 to become the market leader in river cruising and luxury ocean cruising, demonstrating our ability to succeed in each new category we have entered. For the 2024 season, our North American outbound river market share is 52% and our luxury ocean market share is 24%. For the 2023 season, our Mississippi river market share was 20% and our Antarctic expedition market share was 12%. We also continue to grow. For our core products, operating capacity is 5% higher for the 2024 season in comparison to the 2023 season and 12% higher for the 2025 season in comparison to the 2024 season.

9

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

For the year ended December 31, 2023, nearly 650,000 guests traveled with us, and we generated total revenue of $4,710.5 million, a net loss of $1,858.6 million and Adjusted EBITDA of $1,090.3 million. For the six months ended June 30, 2024, over 290,000 guests traveled with us, and we generated total revenue of $2,305.4 million, a net loss of $338.1 million and Adjusted EBITDA of $488.1 million. See Summary Consolidated Financial and Other Data for additional information about Adjusted EBITDA, including a reconciliation of Adjusted EBITDA to net income (loss). We have also generated industry-leading ROIC of 27.5% for the year ended December 31, 2023, up from 26.1% for the year ended December 31, 2019. As of June 30, 2024, we had $1.8 billion of cash and cash equivalents and $5.2 billion of Total Debt. Our payback period for a Longship is on average approximately four to five years based on contributions to operations by a Longship. Our payback period for an ocean ship is on average about five to six years based on contributions to operations by an ocean ship.

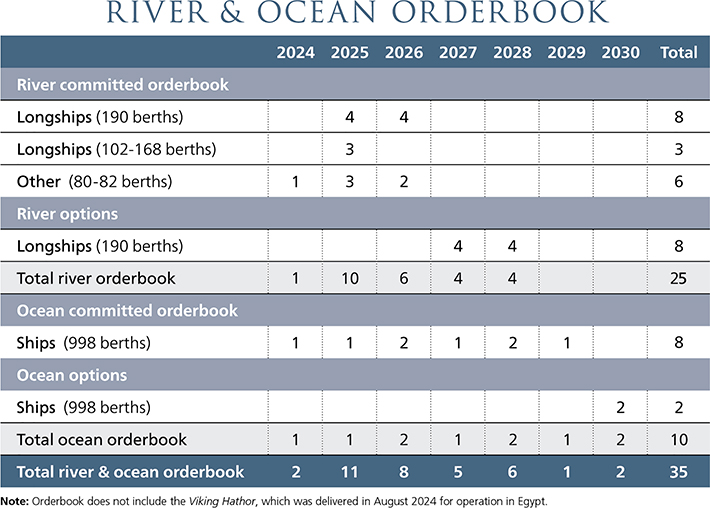

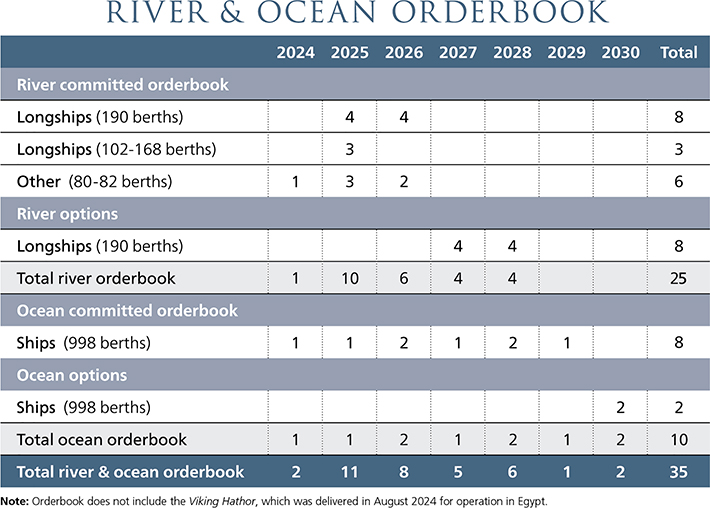

We believe we are well-positioned for future growth. To address the strong demand from our guests, we have ordered 17 new river vessels for delivery through 2026 and eight new ocean ships for delivery through 2029 (two of which are still subject to certain financing conditions).

THE VIKING DIFFERENCE

1. One Brand: Among our guests and across the industry, the Viking brand is synonymous with excellence. Our guests can experience all three categories of the cruise industryocean, river and expedition cruisingunder our single brand. Rather than creating a conglomerate of different brands, all of our products are a consistent extension of the Viking brand. As a result, our marketing spend and strong brand loyalty drive growth for all of our products. We also leverage our strong brand loyalty for future product launches, with over 60% of bookings for each of the inaugural seasons for Viking Ocean, Viking Expedition and Viking Mississippi made by past guests. Our guests know they can expect a consistent, excellent experience on each voyage they take with us, which has allowed us to expand our travel platform successfully with new destinations and experiences. Our repeat guest percentage has steadily increased over time from 27% for the 2015 season to 53% for the 2024 season to date.

2. Identical Small Ships: Our fleet includes 58 identical Longships accommodating 190 passengers, nine identical ocean ships accommodating 930 passengers and two identical expedition ships accommodating 378 passengers. Within each product, our ships are indistinguishable to our guests. This simplifies the sales and marketing process as potential guests shop by itinerary versus by specific ship or age of ship, and it allows older ships to achieve similar yields, even when introducing new ships. Identical ships also create operational flexibility, as well as efficiencies around shipbuilding, maintenance and crew, which improves our margins. Our small ships can dock in ports where larger ships cannot, providing our guests more time ashore for cultural discovery and exploration and offering our guests experiences they cannot have with other cruise lines.

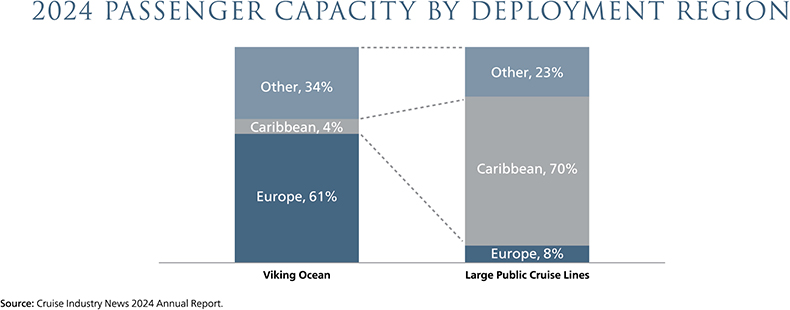

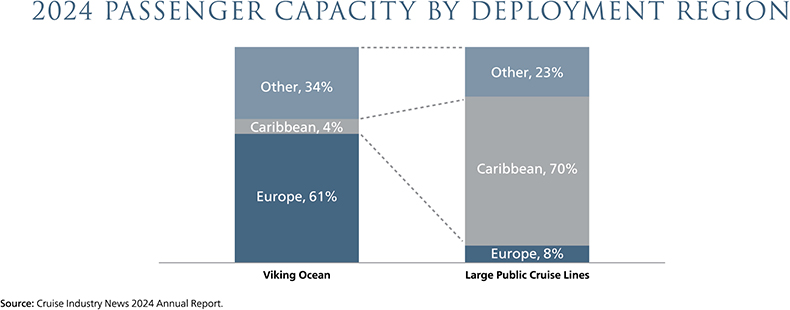

3. Clearly Defined, Destination-Focused Experience: We are the only cruise line offering experiences on all seven continents with itineraries across five oceans, 21 rivers and five lakes, and a focus primarily on destinations in Europe and the Mediterranean, rather than the Caribbean. We deliver a highly differentiated experience for our guests by prioritizing exploration of the destination versus onboard consumption and traditional entertainment. The Viking experience is well-defined and all-inclusive, with a shore excursion included in every port. We are also known for the things that we do not do. For example, no children under 18, no casinos and no hidden ancillary costs, such as charges for alternative restaurants, wi-fi or beer and wine at lunch and dinner. Because of these strategic choices, our guests instantly recognize the Viking way of travel.

10

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

4. Clear Customer Focus: We are intently focused on the travel needs of our core demographic of curious, affluent, English-speaking travelers aged 55 years and older, which is an attractive segment of the travel market. We believe we know our core demographic better than anyone else in the industry and we have tailored our products to specifically address the travel needs of the Thinking Person. We attract individuals seeking travel experiences that offer cultural insight and personal enrichment.

5. Strong Direct Marketing: Since 1997, we have invested $3.0 billion in all aspects of marketing, most of which is direct marketing spend. This investment has helped build and solidify the value of our brand with our target market. Our marketing database includes more than 56 million North American households, including 1.5 million households that have traveled with us before. We generate our own demand through our direct marketing, which allows us to obtain industry-leading early booking rates. Our marketing also drives direct bookings. For the year ended December 31, 2023 and for the 2024 season to date, more than 50% of our guests booked directly with us.

6. Only Pure-Play Luxury Public Cruise Line: Viking is the only pure-play luxury public cruise line. In contrast, the large public cruise lines have multiple brands that serve all three categories of the cruise market, with luxury representing only a small percentage of their overall capacity. Our total revenue per passenger was $7,902 for the six months ended June 30, 2024. Viking defines the luxury category of the river cruise and ocean cruise markets. We believe these are the most attractive segments of the cruise industry and the global luxury leisure travel market given their growth potential.

VIKING STRENGTHS

We have several strengths that have propelled our success and distinguished us from other travel businesses.

High quality products drive strong guest satisfaction and brand loyalty.

We have a proven track record of delivering high quality travel experiences that resonate with our guests, driving strong guest satisfaction and brand loyalty. As a result, our guests are often our greatest promoters. For the 2024 season, as of June 30, 2024, our Net Promoter Scores were 72 for Viking River, 68 for Viking Ocean and 74 for Viking Expedition. Based on our 2024 season survey, as of June 30, 2024, on a scale of 0 to 10, 79.0% and 76.6% of our Viking River and Viking Ocean guests, respectively, answered 9 or 10 on likelihood of recommending Viking to a friend. All our products are also highly rated by our guests. For the 2024 season, as of June 30, 2024, the average guest quality rating of our products was 3.8 on a 4.0 scale, based on onboard surveys completed by over 65% of our guests.

11

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Our strong guest satisfaction and brand loyalty drive repeat bookings with Viking. For the 2024 season to date, our repeat guest percentage is 53% and more than 50% of our guests booked directly with us. Our new product launches have also experienced overwhelming support from our past guests, with over 60% of bookings for each of the inaugural seasons for Viking Ocean, Viking Expedition and Viking Mississippi made by past guests. We have also seen comparable booking trends by past guests for the launch of new river itineraries in Egypt and Vietnam. Our guests trust us to create best-in-class travel experiences, whether it be a new itinerary for a product they already love or a completely new product experience, and we leverage our strong bookings for future seasons and our robust customer insights practice to help identify and deliver on the needs of our core demographic. Expanding our travel platform enables us to capture a greater portion of our core demographics travel spend, while reinforcing brand loyalty, building customer lifetime value and increasing our repeat guest percentage, all of which generate shareholder value.

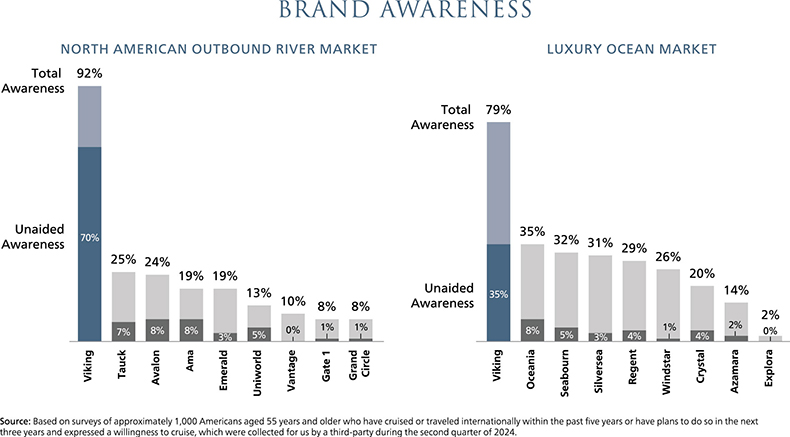

Single Viking brand drives awareness.

For the past 27 years, we have built a single Viking brand that is highly recognized in our target markets and around the world. Today, we are the leading brand in the North American outbound river market and the luxury ocean market. In the second quarter of 2024, we had 92% and 79% total brand awareness for river cruises and ocean cruises, respectively, among our target demographic in the United States. Our total brand awareness for ocean cruises is comparable to the large public cruise lines. Our total brand awareness for river cruises far exceeds the total brand awareness of our nearest competitor in the North American outbound river market and the Mississippi river market.

With a single Viking brand, our strong brand awareness drives growth for our entire travel platform as all of our products are a consistent extension of the Viking experience. We are also able to streamline our marketing, with word-of-mouth marketing and traditional marketing spend driving brand awareness and growth for all of our products.

12

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Clear customer focus on an attractive demographic.

We are intently focused on our core demographic of curious, affluent travelers aged 55 years and older, which we believe is an attractive segment that has been and continues to be underserved by the travel market.

The U.S. population aged 55 years and older comprises 30% of the total population, has the largest spending power of any demographic based on annual expenditures and holds over 70% of U.S. wealth as measured by the U.S. Federal Reserve. The U.S. population aged 55 years and older is also the fastest growing segment of the population, with expected growth from 98 million people in 2020 to 110 million people in 2030, according to the Congressional Budget Office. Our target demographic has greater financial stability, which can make them more resilient to economic conditions and more willing to invest in high-quality travel experiences, including luxury accommodations, unique excursions and cultural activities. Our target demographic often appreciates comfort, convenience and experiential travel that provides a balance between adventure and luxury. Many of our guests are also retired or approaching retirement, which means they often have flexible schedules that allow them to book earlier and plan for extended travel.

After 27 years, we believe we know our core demographic better than anyone else in the industry and have tailored our products to specifically address their unmet needs in the broader travel market. Leveraging our robust customer insights practice and two decades of experience, we know what our guests expect in their travelsa calm onboard atmosphere, with a destination-focused experience offering cultural or scientific enrichment. Our guests spend their time enjoying the peaceful ambiance of resident musicians, participating in enriching educational opportunities, such as onboard lectures from local historians, or debriefing their exciting day with fellow guests over a delicious meal from the ships regional specialties menu. At Viking, we think of every detail, so our guests can focus on exploring and learning about their destinations.

Data-driven marketing platform drives demand.

Since 1997, we have invested $3.0 billion across all aspects of marketing. We have been a national corporate sponsor of PBSs Masterpiece Theatre since 2011 when Downton Abbey was on the air, establishing Viking as a household name, and we continue to run television advertisements on other national programming targeting our core demographic, including during NBCs coverage of the Paris Games. We have forged partnerships with prestigious cultural institutions, such as the Los Angeles Philharmonic, the British Museum and the Metropolitan Opera. We also created Viking.tv, one of the travel industrys most extensive libraries of online content. This award-winning free enrichment channel was initially conceived to maintain daily contact with our guests during the COVID-19 pandemic, and continues to stream daily, with over 1,000 unique episodes since first airing. Additionally, we host hundreds of journalists and influencers on board our ships each year, generating robust earned media coverage and social media content. These efforts create a clear path for positive affiliation with the Viking brandhelping move guests from awareness into consideration.

Built over the last 27 years, our marketing database includes more than 56 million North American households, including 1.5 million households that have traveled with us before. While we have always relied on traditional marketing strategies, including direct mail, TV, print and trade marketing, our marketing approach today is omnichannel, with robust digital capabilities and data-driven decision-making. For example, our marketing is underpinned by digital industry tools that provide programmatic execution, machine learning capabilities, look-alike prospecting, online to offline conversions and call tracking, emerging artificial intelligence (AI) supported functionality and data-driven marketing attribution. The households in our database are modeled and scored for their propensity to book. These scores, combined with our attribution systems and a robust consumer insights practice, direct how we tailor our marketing in order to meet consumers where they are, with the right message at the right time. We also continue to shift our marketing spend towards digital channels.

13

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Once guests travel with us, our marketing positioning is reinforced by a shared experience among individuals seeking travel experiences for the Thinking Person. Our guests connect with each other over mutual interests in history, art, culture and travel, and as a result, countless new friendships are forged on board our ships each year. Approximately 18% of our Viking Ocean and Viking Expedition guests booked their next Viking voyage while on board in 2023with many planning future trips together with fellow travelers. And, just like the fervent communities formed around beloved books and films, guests self-described as hooked on Viking have launched their own fan groupsseveral of which have amassed more than 40,000 memberson social media platforms where we are able to target them with digital marketing for their next Viking voyage.

Our multiple distribution channels optimize yields and improve margins.

We provide our guests with a variety of ways to seamlessly book their voyages, so that they can transact with us however they are most comfortable. Guests have the option to book with a third-party travel agent or directly with Viking. By offering multiple channels to serve our guests, we reduce friction in the booking process, which optimizes yields. Guests can book directly with Viking through multiple outlets, including our website, via online chat with an agent, over the phone, or on board our ships that have a dedicated travel consultant. For the year ended December 31, 2023 and the 2024 season to date, more than 50% of our guests booked directly with us.

We also partner with travel agencies to generate a significant portion of our sales. We have preferred relationships with large travel agent consortia and we are committed to maintaining and strengthening our relationships with our travel agent partners. With a marketing database that includes more than 56 million North American households, we also believe our marketing spend benefits all distribution channels and drives earlier bookings, including during times of softening demand in the broader travel market.

Early bookings create strong revenue visibility and facilitate long-term planning.

For the 2024 season, we began selling select itineraries more than two years prior to the start of the season. On average for the 2023 season, our guests booked 11 months in advance and paid seven months prior to departure. By generating early demand through our direct marketing, we believe we attain bookings earlier than the large public cruise lines. Additionally, we collect payment earlier than the large public cruise lines, which we believe reduces cancellations. This creates future revenue visibility, which enables us to better manage our capacity and pricing. This visibility also gives us the ability to plan for future ship commitments years in advance.

We have a proven track record of selling Capacity PCDs well in advance of sailing. For our core products, operating capacity is 5% higher for the 2024 season in comparison to the 2023 season and 12% higher for the 2025 season in comparison to the 2024 season. As of August 11, 2024, for our core products, and for the 2024 and 2025 seasons, we had sold 95% and 55%, respectively, of our Capacity PCDs and had $4,642 million and $3,442 million, respectively, of Advance Bookings. Advance Bookings were 14% and 20% higher in comparison to the 2023 and 2024 seasons, respectively, at the same point in time. Advance Bookings per PCD for the 2024 season was $731, 8% higher than the 2023 season at the same point in time, and Advance Bookings per PCD for the 2025 season was $833, 10% higher than the 2024 season at the same point in time.

Young fleet with innovative design drives efficiency and profitability.

At Viking, we build innovative ships that are the right size for the experience. From the outset, we creatively balance competing preferences for smaller ships and spacious, uncrowded shared areas through greater efficiencies in space utilization and operations. No space is wasted onboard, and the overall ship design

14

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

thoughtfully optimizes efficiency and profitability. For example, for Viking Ocean, the layout of our ships allows us to operate with fewer crew while still delivering an exemplary level of service. And for Viking River, the unique design of our Longships allows us to comfortably accommodate approximately 20% more guests than typical European river vessels, improving the profitability of our vessels.

As part of our approach to fleet design, our Viking Ocean, Viking Expedition and the majority of our Viking River fleet are identical at the product level, which provides us with many benefits. This simplifies the sales and marketing process as potential guests shop by itinerary versus by specific ship or age of ship and allows older ships to achieve similar yields, even when introducing new ships. From an operational perspective, fleet commonality creates efficiencies around maintenance, as spare parts can be purchased in bulk in advance for unforeseen or planned maintenance, and crew, as crew can be moved around the fleet with minimal additional training. Lastly, our identical fleet gives us operational flexibility to interchange guests between ships in the event of unexpected disruptions, such as when we positioned identical Longships on adjacent sides of low water areas to avoid any cancellations during record low water levels in Europe in 2022. In 2022, 14% of our Rhine River sailings involved ship swaps and these sailings received high guest quality ratings that were comparable to our guest quality ratings for non-impacted Rhine River sailings.

We also have one of the youngest fleets in the industry. As of June 30, 2024, the average age for our fleet available for operations, which excludes six Russia and Ukraine river vessels, was 7.0 years, which is younger than the average age for the large public cruise lines. We believe customers are willing to pay a premium to sail on newer ships, which results in higher yields. A young fleet also has more efficient operations, including from technological advances that result in lower fuel consumption, resulting in stronger margins. A young fleet also requires lower maintenance capital expenditures, which allows us to direct most of our capital expenditures to fleet expansion and the launch of new product offerings, which ultimately means that more of our capital is invested in initiatives designed to grow our revenue and cash flows as opposed to maintaining revenue and cash flows at current levels.

Fuel-efficient fleet designed to meet future environmental regulations.

From the outset, we have designed all of our ships thoughtfully to reduce their fuel consumption, carbon footprint and overall environmental impact. Our Longships are one of the first cruise vessels to be voluntarily certified with the Green Award and are also certified with the European ISO 14001 Environmental Management practices. Our ocean ships, with their sleek hull design and closed-loop scrubbers that allow us to use more cost-efficient fuel, exceed the current requirements of the International Maritime Organization (IMO) Energy Efficiency Design Index (EEDI) by approximately 25%, and will exceed the 2025 EEDI requirements by almost 20%. Our expedition ships set a new standard for responsible travel by exceeding the current requirements of the EEDI by nearly 38%. Due to the design choices across our fleet, our fuel costs represented only 5.7% of our Adjusted Gross Margin for the year ended December 31, 2023, favorably positioning us if fuel prices increase or regulations require the use of more expensive fuel types. With only minor modifications, the engines of our Longships, ocean ships, and expedition ships can also operate on hydrotreated vegetable oil (HVO) renewable diesel, which could reduce greenhouse gases by up to 90% over the fuels life cycle compared to diesel.

Looking forward, we are working to make our next generation of ocean ships even more environmentally friendly. We have made the principled decision not to invest in liquefied natural gas (LNG), which is composed almost exclusively of methane, a greenhouse gas with a global warming potential more than 80 times (over a 20-year period) or 28 times (over a 100-year period) that of carbon dioxide. Instead, we are working on a project for a partial hybrid propulsion system based on liquid hydrogen and fuel cells, which could allow us to operate at zero-emission in the Norwegian Fjords and other sensitive environments.

15

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Seasoned, proven management team committed to long-term shareholder value.

We are a founder-led and inspired organization with an enduring commitment to creating shareholder value over the long-term. In addition to Torstein Hagen, our Chairman and Chief Executive Officer, we benefit from the industry expertise and tenure of our proven management team of Leah Talactac, our Chief Financial Officer, Linh Banh, our Executive Vice President, Finance, Jeff Dash, our Executive Vice President, Head of Business Development, Karine Hagen, our Executive Vice President, Product, Anton Hofmann, our Executive Vice President, Group Operations, Milton Hugh, our Executive Vice President, Sales and Richard Marnell, our Executive Vice President, Marketing, who have all worked together for over 15 years.

Excluding our Chairman and Chief Executive Officer, our management team has an average tenure of 21 years at Viking and 25 years in the travel industry. The same management team revolutionized the river cruising industry with the design and launch of the Longships in 2012, and introduced Viking Ocean in 2015, which marked the industrys first entirely new ocean cruise line in nearly a decade. This team identified a market need for a smaller ship, destination-focused ocean product, which continues to be a key driver in our growth. More recently, this team launched Viking Expedition and Viking Mississippi in 2022, meeting guest demands. Along with launching new products, this team has also been successful in broadening our presence in existing source markets and garnering leading market share and entering new source markets, such as China. From 2020 to June 30, 2024, this team also added 18 new ships to our fleet, including 11 river vessels, four ocean ships, two expedition ships and the Viking Mississippi. This team has driven our growth over the past two decades, with our annual guests growing from 80,000 in 2007 to nearly 650,000 in 2023, an increase of over 700%. This team also has a proven record of capitalizing on opportunities as they arise. For example, given our long-term outlook, we have a record of ordering newbuilds, including our initial ocean ships, during off cycles when other cruise operators focused on conserving capital. Currently, we have ordered 25 additional newbuilds through 2029 to capture future demand (two of which are still subject to certain financing conditions).

Our management team has capitalized on opportunities during times of adversity, weathered several economic cycles together and ultimately built Viking to be the company it is todaya household brand name with industry-leading quality ratings, numerous awards and a sizeable market share in the fast-growing luxury cruise market.

Dedicated crew delivers exemplary level of service.

Our crew, with over 9,500 crewmembers from over 90 different countries at the peak of the 2023 season, are dedicated to making our guests journeys as memorable as possible. Our crew is essential to our success. Our crews friendliness, attentiveness and attention to detail have garnered us more consumer and industry awards than any other travel company on rivers or oceans. Most importantly, our crew is a significant reason that we receive high satisfaction ratings from our guests.

As part of the Viking family, we care deeply about our crew, and we provide the training, skills and resources needed for them to excel. Our proprietary training program, Viking College, helps our crew learn and grow. We also place great value on promotion from within, rewarding hard work, enthusiasm, initiative and a sense of responsibility and ownership. We aspire to be the employer of choice among cruise lines and our crew retention rate of about 80% as of December 31, 2023 is a source of great pride. Retaining our crew season after season lowers our recruiting and training costs. It also supports our growthwe are able to distribute our tenured crew across our new ships to streamline the hiring and training of new crew. A mix of new and tenured crew on each ship ensures a consistent high quality of service and a familiar onboard experience for our guests as we grow our business.

VIKING STRATEGIES FOR GROWTH

We believe our journey as one of the most recognized luxury travel brands in the world is just beginning. We believe we are well-positioned to drive future growth and profitability with the following strategies, each of which represents a continuation of the proven strategies we have been executing over the past 27 years.

16

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Expand our fleet to address unmet demand from our core demographic.

We believe the travel market for curious, affluent travelers aged 55 years and older continues to be significantly underserved. There is also a general gap between demand and supply in cruising, which we have an opportunity to address.

To capitalize on this growing and unmet demand, we plan to continue expanding our fleet, with the most contracted future ship deliveries in the industry. According to the 2024 Cruise Industry News Orderbook Data (published August 2024), approximately 15% of total new berths coming online globally by 2029 are attributable to ships in the luxury ocean market and our contracted capacity represents approximately 37% of this new comparable supply, positioning us favorably to take advantage of increased demand for cruising within our target market. For Viking River, we have ordered 17 new vessels for delivery by 2026, including 11 river vessels for the European rivers, five river vessels that will operate in Egypt and a chartered river vessel that will travel through Vietnam and Cambodia, and we expect to sustain our market leading position in the river cruising market well into the future. We also have options for eight additional river newbuilds, with four for delivery in 2027 and four for delivery in 2028. For Viking Ocean, we believe there is significant future growth potential, which we will begin to achieve with eight new ocean ships on order for delivery through 2029. We also have options for two additional ocean newbuilds for delivery in 2030. Based on our committed orderbook, we expect a 47.0% increase in total berths for our fleet available for operations, which excludes six Russia and Ukraine river vessels, from 2023 to 2029. Our orderbook, the largest in the cruise industry, is driven by a disciplined strategy that relies heavily on robust consumer insights and market demand assessment, combined with financing and yield considerations.

As we add new capacity, we conduct extensive research to identify new itineraries that will fill gaps in the travel market for our core demographic. For example, we recently added new itineraries in China and Japan for our core demographic on the Zhao Shang Yi Dun, which we are marketing as the Viking Yi Dun for our core

17

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

demographic. Based on prior experience, we expect new itineraries to inspire past guests to travel again and attract new guests to the Viking brand, which we believe will result in a higher repeat guest percentage and enhanced customer lifetime value at marginal marketing expense.

In addition to growing our fleet and adding new itineraries, we also plan to continue optimizing our inventory of add-on products, such as pre-and post-trip cruise extensions, which unlock additional revenue growth opportunities without significant capital expenditures. Our pre-and post-trip cruise extensions, such as a three-night tour of the historic town of Oxford and Highclere Castle or the real Downton Abbey, further enrich the destination-focused experience of our itineraries and provide another opportunity for us to connect our guests with the cultures and destinations on our itineraries. In 2023, 37% of our guests purchased a pre-or post-trip cruise extension to take advantage of these opportunities. Pre-or post-trip cruise extensions are currently offered at an average of over $900 per extension and are typically two or three days. In 2023, our guests spent on average $45 per PCD on pre- and post-trip cruise extensions.

Increase guests from outside of North America.

While North America is the largest source market for the cruise industry, generally about 50% of all cruisers globally are from markets outside of North America, according to the Cruise Lines International Association (CLIA). In contrast, for the year ended December 31, 2023, 90.5% of our guests came from North America, with the remainder primarily coming from the United Kingdom, Australia and New Zealand. We believe there is significant unmet demand for our core products in the United Kingdom, Australia and New Zealand. We also believe there is an opportunity to source guests for our core products from other markets, such as India, Singapore and the Nordic countries. In order to provide a seamless experience for our guests, all of our onboard and onshore programming is offered in a singular language. For our core products, all programming is in English and for our China Outbound product, all programming is in Mandarin.

Continue to expand Viking China and launch products for new source markets.

The Chinese market is a large source for leisure travel. According to the World Bank and CLIA, there were 154.6 million international departures from China in 2019 and 1.9 million passengers from China traveled on a cruise line in 2019, which made it one of the largest and fastest growing outbound travel markets in the world. While the Chinese outbound market has been slower to rebound from the COVID-19 pandemic, we believe Chinese tourists maintain a strong desire to travel internationally. According to Oxford Economics, China is expected to regain its pre-pandemic share of global outbound visits, which was 7.1% in 2019, by 2026.

In 2016, we brought our brand of curiosity-driven travel to the Chinese source market by launching China Outbound, a river cruise experience in Europe with 100% Mandarin-speaking crew, and food, entertainment and excursions completely dedicated to Chinese guests. As a result, we believe we are uniquely positioned to capitalize on the Chinese market, which represents a continued opportunity for growth. Mandarin-speaking travelers in China, as well as other Asian-source markets, have been historically underserved by the cruise industry and we have identified a sizeable addressable market. We believe we are the only cruise line with a product dedicated to Mandarin-speaking guests in Europe and the launch of China Outbound in 2016 was just the beginning. By leveraging our brand awareness in China and our extensive research into the travel preferences of affluent Mandarin-speaking guests, we plan to continue to develop China Outbound, with the possibility of growing the fleet or expanding to include other offerings, such as ocean cruising. For coastal cruising in China, the China JV Investments Zhao Shang Yi Dun has a competitive advantage in the upper premium cruise line space as it is the only modern cruise ship currently in this market.

There are also opportunities to bring our brand of curiosity-driven travel to other source markets. Similar to China Outbound, new source markets provide an exciting opportunity to tailor our existing products exclusively to these source markets, while leveraging our experience building our core products with a singular language and potentially using a portion of our existing fleet.

18

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

Strategically expand our product portfolio.

We believe we can harness our global travel expertise, experienced operational team and deep understanding of our core demographic to further expand our platform. Based on our robust customer insights practice and third-party research, we believe there is considerable demand for other Viking products from our past guests, as well as from our broader core demographic. In particular, we believe there is significant future opportunity to expand beyond floating hotels to create dedicated land-based products given the strong demand for our pre-and post-trip extensions. As our guests generally enjoy multiple forms of travel and take multiple trips per year, land-based product offerings would meet an additional portion of the travel needs of our core demographic. This would enable us to capture a greater share of our guests travel spend and extend our customer lifetime value and connection to the Viking brand.

FINANCIAL PERFORMANCE

Our financial performance reflects the growing demand for our products, our strong capacity growth and the benefits of our loyal customer base. Our loyal guests book their journeys well in advance, and as a result, we have industry-leading early booking rates, which give us a competitive advantage in allocating capacity, optimizing pricing, managing yield and planning for future ship commitments years in advance. As a result, we are able to generate high margins and leading ROIC among the large public cruise lines. For the year ended December 31, 2023, our ROIC was 27.5%. We have also historically generated substantial net cash flow from operating activities and Adjusted FCF that we have reinvested in our business to support growth. For the year ended December 31, 2023, we generated $1.4 billion in net cash flow from operating activities and $1.0 billion of Adjusted FCF, which translates to an Adjusted FCF Conversion of 92.3%. See Summary Consolidated Financial and Other Data for additional information about ROIC and Adjusted FCF, including a calculation of ROIC and a reconciliation of net cash flow from operating activities to Adjusted FCF. Our strong balance sheet provides flexibility to finance future growth at attractive terms. As of June 30, 2024, we had $1.8 billion of cash and cash equivalents and $5.2 billion of Total Debt.

Like all other companies in the travel industry, our operations were impacted by the COVID-19 pandemic. In March 2020, we were the first cruise line to halt operations. From that point on, we spent significant resources implementing new health and safety protocols, including adding onboard testing laboratories on our ocean and expedition ships. These investments allowed us to restart operations in May 2021, with more than half of our river fleet and all six of our ocean ships operating at the peak of the 2021 season.

By 2022, more of our guests were traveling again. In 2022, 469,935 guests traveled with us, with an Occupancy of 78.4%, and in 2023, 649,669 guests traveled with us (38.2% more than 2022 and 26.7% more than 2019), with an Occupancy of 93.7%. We believe our nimble operations, our experienced, cohesive management team and our consistent execution distinguishes us from other travel businesses and accelerated our recovery, both on a total revenue and an Adjusted EBITDA basis, in comparison to the large public cruise lines.

This strategy resulted in the following results from 2017 to 2023:

| | Total revenue increased from $1.9 billion for the year ended December 31, 2017 to $4.7 billion for the year ended December 31, 2023. |

| | Gross margin increased from $0.6 billion in 2017 to $1.6 billion in 2023. |

| | Adjusted Gross Margin increased from $1.2 billion for the year ended December 31, 2017 to $3.1 billion for the year ended December 31, 2023. |

| | Net loss increased from $55.1 million for the year ended December 31, 2017 to $1,858.6 million for the year ended December 31, 2023. Net loss includes losses, net, of $20.7 million and $2,101.9 million for 2017 and 2023, respectively, due to the impact of the Private Placement derivatives gain (loss) and interest expense related to our Series A Preference Shares, Series B Preference Shares and Series C Preference Shares, as applicable. Our Series A Preferences Shares, Series B Preference Shares and Series C Preference Shares are no longer outstanding. |

19

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

| | Adjusted EBITDA and Adjusted EBITDA Margin increased from $324.8 million and 26.3%, respectively, for the year ended December 31, 2017 to $1,090.3 million and 35.5%, respectively, for the year ended December 31, 2023. |

This strategy has also generated strong results in the most recent six months ended June 30, 2024, where we have observed:

| | Total revenue increased from $2.1 billion for the six months ended June 30, 2023 to $2.3 billion for the six months ended June 30, 2024. |

| | Gross margin increased from $0.7 billion for the six months ended June 30, 2023 to $0.8 billion for the six months ended June 30, 2024. |

| | Adjusted Gross Margin increased from $1.4 billion for the six months ended June 30, 2023 to $1.5 billion for the six months ended June 30, 2024. |

| | Net loss increased from $24.3 million for the six months ended June 30, 2023 to $338.1 million for the six months ended June 30, 2024. Net loss included gains, net, of $18.9 million and losses of $396.2 million for the six months ended June 30, 2023 and 2024, respectively, due to the impact of the Private Placement derivative gain (loss) and interest expense related to our Series C Preference Shares, as applicable. Our Series C Preference Shares are no longer outstanding. |

| | Adjusted EBITDA and Adjusted EBITDA Margin increased from $390.7 million and 28.7%, respectively, for the six months ended June 30, 2023 to $488.1 million and 31.8%, respectively, for the six months ended June 30, 2024. |

See Summary Consolidated Financial and Other Data for additional information about Adjusted Gross Margin and Adjusted EBITDA, including a reconciliation of Adjusted Gross Margin to gross margin and a reconciliation of Adjusted EBITDA to net income (loss).

20

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

RECENT DEVELOPMENTS

Fleet Expansion

In August 2024, we took delivery of the Viking Hathor, a river vessel that will operate in Egypt. The Viking Hathor accommodates 82 passengers and joins our growing fleet of state-of-the-art ships for the Nile River. Except for information provided as of June 30, 2024, all information about our fleet contained herein has been updated to include the Viking Hathor.

In September 2024, the Zhao Shang Yi Dun, which is owned and operated by CMV, is operating its initial itineraries in China as part of the Viking Ocean deployment sold to our core demographic. The Zhao Shang Yi Dun, which we are marketing as the Viking Yi Dun for our core demographic, is identical to our other ocean ships, accommodating 930 passengers. We have purchased allotments for all cabins on the Zhao Shang Yi Dun for the Viking Ocean deployment for 72 days in 2024. Information about our fleet contained herein does not include the Zhao Shang Yi Dun.

RISK FACTORS

Investing in our ordinary shares involves substantial risks, and our ability to successfully operate our business and execute our growth plan is subject to numerous risks. You should carefully consider the risks described in Risk Factors before making a decision to invest in our ordinary shares. If any of these risks actually occur, our business, financial condition or results of operations could be materially and adversely affected. In such case, the trading price of our ordinary shares would likely decline, and you may lose all or part of your investment. These risks include, among others, the following:

21

Table of Contents

CONFIDENTIAL TREATMENT REQUESTED BY VIKING HOLDINGS LTD

PURSUANT TO 17 CFR 200.83.

| | Changes in the general worldwide economic and political environment could reduce the demand for cruises. |

| | Adverse weather conditions or other natural disasters, including high or low river water levels, may require us to alter our itineraries or cancel existing cruises. |

| | Adverse incidents involving cruise ships may adversely affect our business, financial condition and results of operations. |

| | Disease outbreaks or pandemics have had, and in the future could have, a significant impact on the travel industry generally and on our business and results of operations. |

| | The threat of terrorist attacks, wars, acts of piracy and other events affecting the safety and security of travel can reduce the demand for cruises or require us to cancel existing bookings. |

| | Changes in fuel prices would affect the cost of our cruise ship operations and our hedging strategies may not protect us from increased costs related to fuel prices. |

| | Increased labor costs or our inability to recruit or retain employees may adversely affect our business, financial condition and results of operations. |

| | Increases in inflation could adversely affect our business, financial condition and results of operations. |

| | Fluctuations in foreign currency exchange rates could affect our financial results. |

| | An increase in cruise capacity without a corresponding increase in demand and infrastructure could adversely affect our business, financial condition and results of operations. |

| | Our success is substantially dependent on the continued service of our senior management. |

| | Our expansion into new products may be unsuccessful. |

| | Conducting business internationally may result in increased costs and risks. |

| | If we experience delays in ship construction or ship repairs, maintenance or refurbishments or changes in costs, our business, financial condition and results of operations could be adversely affected. |

| | Lack of continuing availability of attractive, convenient and safe port destinations could adversely affect our business, financial condition and results of operations. |

| | We rely on travel agencies to generate a material portion of our sales. |

| | Reductions in the availability of and increases in the prices for the services and products provided by our vendors could adversely affect our business and revenues. |

| | We rely on scheduled commercial airline services to transport our guests to or from the cities where our cruises embark and disembark. |

| | Credit card processing terms and requirements, adverse changes in guest payment policies, and consumer protection legislation or regulations could negatively affect our financial condition. |

| | The Viking name and brand are integral to the success of our business. |