EX-10.24

Published on April 5, 2024

Exhibit 10.24

Confidential

Execution Version

NEITHER THIS WARRANT (THIS WARRANT) NOR THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OR ANY APPLICABLE STATE SECURITIES LAW AND NEITHER MAY BE SOLD OR OTHERWISE TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR APPLICABLE STATE SECURITIES LAWS OR AN EXEMPTION FROM REGISTRATION THEREUNDER. THE TRANSFER OF THIS WARRANT AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF IS ALSO SUBJECT TO THE CONDITIONS SPECIFIED IN THIS WARRANT.

WARRANT TO PURCHASE

ORDINARY SHARES OF

VIKING HOLDINGS LTD

| Warrant #OS-2 |

February 8, 2021 |

FOR VALUE RECEIVED, Viking Holdings Ltd, an exempted company incorporated with limited liability under the laws of Bermuda, having its registered office at Clarendon House, 2 Church Street, Hamilton, HM 11, Bermuda (the Company), hereby certifies that Viking Capital Limited, a company incorporated in the Cayman Islands with company number CT-248737 (VC), or its registered assigns (Holder), is entitled, subject to the terms and conditions set forth below, to purchase from the Company, during the Exercise Period, up to 167,950 Warrant Shares at a purchase price of US$0.01 per share (the Exercise Price). The Exercise Price and number of Warrant Shares issuable hereunder are each subject to appropriate adjustment from time to time as set forth herein (the maximum number of Warrant Shares issuable hereunder, as so adjusted, the Total Warrant Shares). This Warrant is issued in connection with the financing being provided to the Company under the Subscription Agreement.

The following is a statement of the rights of Holder and the conditions to which this Warrant is subject, and to which Holder, by the acceptance of this Warrant, agrees:

1. Duration of Warrant. This Warrant may be exercised pursuant to Section 2(d) during the period commencing on the date hereof and terminating at 5:00 p.m., New York City time, on the 10-year anniversary of the date hereof (the Exercise Period).

2. Vesting. The period for vesting of this Warrant (the Vesting Period) shall commence on the date hereof and expire upon the later to occur of (i) 5:00 p.m., New York City time, on the five-year anniversary of the date hereof and (ii) the sale, distribution or other transfer of all Capital Stock in the Company held by the Applicable Investor (which shall include a sale of 100% of the equity of the Applicable Investor by its Affiliates as of the date hereof) to a third party that is not an Affiliate of the Applicable Investor or an investment fund under common management with the Applicable Investor or its Affiliates (and excluding any internal Transfers involving the Applicable Investor and its Affiliates or investment funds under common management, in whatever form). This Warrant shall vest with respect to the Applicable Percentage of the Total Warrant Shares upon the occurrence of any of the following during the Vesting Period:

(a) upon the sale, distribution or other transfer of all Capital Stock in the Company held by the Applicable Investor (which shall include a sale of 100% of the equity of the Applicable Investor by

its Affiliates as of the date hereof) to a third party that is not an Affiliate of the Applicable Investor or an investment fund under common management with the Applicable Investor or its Affiliates (and excluding any internal Transfers involving the Applicable Investor and its Affiliates or investment funds under common management, in whatever form), whether in one or multiple sales, distributions or other transfers, or upon the closing of an Asset Sale, and in each case, whether prior to or following an IPO; or

(b) at any time following an IPO and the expiration of any market stand-off agreement entered into by the Applicable Investor pursuant to Section 2.10 of the Investor Rights Agreement in connection with such IPO (excluding any market stand-off agreement relating to any follow-on offering), if the Warrant Shares shall have achieved the VWAP set forth in Section 2(c)(ii) below for at least 20 trading days out of any 30 trading day period.

(c) For the purposes of this Warrant, Applicable Percentage means:

(i) in the case of vesting under Section 2(a), the percentage set forth in the table below under the heading Applicable Percentage corresponding to (A) the average price per share, calculated on an as-converted to Warrant Shares basis, realized by the Applicable Investor on the sale, distribution or other transfer of all Capital Stock in the Company held by the Applicable Investor (in each case, valued based on the proceeds actually received by the Applicable Investor) or upon any distribution of proceeds of or stock, securities or other assets (including cash) in connection with an Asset Sale (the Average Per Share Amount); provided that: (A) if the consideration received by the Applicable Investor is in the form of publicly traded securities, the value of such consideration shall be calculated based on the closing price on the date of receipt by the Applicable Investor; and (B) if such consideration is not cash, cash equivalents or publicly traded securities, then the value of such consideration (the Consideration Value) shall be determined in the manner set forth in Section 2(e) (provided that, in the case of the foregoing clauses (A) and (B), the average price per share realized by the Applicable Investor shall be increased by an amount equal to the aggregate per share amount by which actual dividends or distributions paid (whether in cash, shares or other property) in respect of the Applicable Investors shares exceeds the amounts mandatorily payable by the Company under Bye-Law 4.7.2 (any such excess aggregate amount, the Per Share Dividend Accrual, and the sum of (1) the Average Per Share Amount and (2) the Per Share Dividend Accrual, the Section 2(a) Vesting Per Share Value)):

| Section 2(a) Vesting Per Share Value |

Applicable Percentage |

|

| US$400 or less per Ordinary Share |

0% |

|

| Between US$400 and US$600 per Ordinary Share |

Such percentage between 0% and 100% as is calculated based on linear interpolation between such numbers (e.g., US$450 would result in an Applicable Percentage of 25%). |

|

| US$600 or more per Ordinary Share |

100% |

|

(ii) in the case of vesting under Section 2(b), the percentage set forth in the table below under the heading Applicable Percentage corresponding to (A) the applicable VWAP achieved

- 2 -

for at least 20 trading days out of any 30 trading day period pursuant to Section 2(b) plus (B) the Per Share Dividend Accrual (if any) (the sum of (A) and (B), the Section 2(b) Vesting Per Share Value):

| Section 2(b) Vesting Per Share VWAP |

Applicable Percentage |

|

| VWAP US$400 or less |

0% |

|

| VWAP between US$400 and US$600 |

Such percentage between 0% and 100% as is calculated based on linear interpolation between such numbers (e.g., US$450 would result in an Applicable Percentage of 25%). |

|

| VWAP US$600 or more |

100% |

|

(d) Unless and until the Applicable Percentage is equal to 100%, the Warrant shall remain eligible for continued vesting during the Vesting Period based on the achievement of higher vesting thresholds (either pursuant to Section 2(a) or Section 2(b)). For the avoidance of doubt, in all cases, the Applicable Percentage shall be calculated as a percentage of the Total Warrant Shares as of the Effective Date (subject to the adjustments set forth herein) and not on the basis of the Total Warrant Shares under any Replacement Warrant.

(e) In connection with any determination of Consideration Value, Holder and the Company shall negotiate in good faith to mutually agree upon the Consideration Value. If Holder and the Company cannot agree upon the Consideration Value within twenty (20) Business Days following the event giving rise to the determination of the Consideration Value (the Triggering Event) (or such longer period as Holder and the Company may mutually agree upon), then within ten (10) Business Days of the end of such twenty (20) Business Day period, the Company and Holder shall each select an unaffiliated, independent appraiser who has expertise and experience in the valuation of assets of the relevant type (Designated Appraisers) and shall request each Designated Appraiser to separately determine the Consideration Value as of the date of the applicable Triggering Event as may be agreed between Holder and the Company. The Company and Holder shall provide to the Designated Appraisers such information, including, without limitation, financial and other business information, regarding the Company as may be reasonably requested by either of the Designated Appraisers. Holder and the Company shall use their reasonable best efforts to cause each Designated Appraiser to render a written decision regarding its determination of the Consideration Value within twenty (20) Business Days following the submission thereof. If the Company or Holder fails to designate a Designated Appraiser, then the Consideration Value shall be as determined by the sole Designated Appraiser. If the two values determined by the two Designated Appraisers are within ten percent (10%) of each other, then the Consideration Value shall be deemed to equal the average of such values. If the two values determined by the two Designated Appraisers are not within ten percent (10%) of each other, then the determination of Consideration Value shall be submitted to a third unaffiliated, independent appraiser who has expertise and experience in the valuation of assets of the relevant type (the Jointly Selected Appraiser), which appraiser shall be selected by mutual agreement of the Company and Holder or by the Designated Appraisers within ten (10) Business Days following the determination of the Consideration Value by both of the Designated Appraisers. If neither the Company and Holder nor the Designated Appraisers can agree upon the Jointly Selected Appraiser, then either party can request that the Jointly Selected Appraiser be selected by the American Arbitration Association. The Jointly Selected Appraiser may use the reports, data and work papers of the Designated Appraisers. The Company and Holder shall use their respective reasonable best

- 3 -

efforts to cause the Jointly Selected Appraiser to render a written decision regarding its determination of the Consideration Value within twenty (20) Business Days following the submission thereof. The Consideration Value as determined by the Jointly Selected Appraiser shall be between the two values of Consideration Value as determined by the Designated Appraisers. The determination of the Consideration Value shall be final and binding upon the Company and Holder, and shall constitute Consideration Value. The fees and expenses of the Designated Appraisers and, if applicable, any fees and expenses of the Jointly Selected Appraiser or the American Arbitration Association, shall be borne by the Company.

3. Exercise.

(a) Method of Exercise. Subject to the terms and conditions of this Warrant, Holder may exercise this Warrant in whole or in part with respect to any Warrant Shares which have vested during the Vesting Period, at any time or from time to time, on any Business Day during the Exercise Period. In order to exercise this Warrant, Holder shall give written notice to the Company, in the form attached hereto as Exhibit A (the Election Notice), duly executed by Holder, of its election to exercise.

(b) Payment. Unless Holder elects to net exercise in accordance with Section 3(e), Holder shall, as a condition to any exercise, deliver to the Company by (i) check payable to the Company, (ii) wire transfer of immediately available funds in accordance with the Companys instructions, or (iii) any combination of the foregoing, an amount equal to the product obtained by multiplying the Exercise Price by the number of Warrant Shares set forth under the heading Cash Exercise on the Election Notice.

(c) Partial Exercise. Upon a partial exercise of this Warrant, this Warrant shall be cancelled and replaced with a new Warrant (the Replacement Warrant) on terms identical to those contained in this Warrant, except that the maximum number of Warrant Shares issuable upon exercise shall be equal to the maximum number of Warrant Shares issuable under this Warrant (as stated in the first paragraph set forth above) reduced by (i) the number of Warrant Shares set forth under the heading Cash Exercise on the Election Notice or (ii) the number of shares calculated pursuant to Section 3(e), as applicable.

(d) Fractional Shares; Effect of Exercise.

(i) No fractional shares shall be issued upon exercise of this Warrant. In lieu of the Company issuing any fractional shares to Holder upon the exercise of this Warrant, the Company shall pay to Holder an amount equal to the product obtained by multiplying the Exercise Price by the fraction of a share not issued pursuant to the previous sentence.

(ii) Upon partial exercise of this Warrant and the issuance of the Replacement Warrant, the Company shall be forever released from all its obligations and liabilities under this Warrant and this Warrant shall be deemed of no further force or effect, whether or not the original of this Warrant has been delivered to the Company for cancellation. Upon exercise of this Warrant in full, the Company shall be forever released from all its obligations and liabilities under this Warrant and this Warrant shall be deemed of no further force or effect, whether or not the original of this Warrant has been delivered to the Company for cancellation.

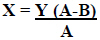

(e) Net Exercise. Holder may elect to exercise all or any portion of this Warrant with respect to any Warrant Shares which have vested by net exercise. The number of Warrant Shares to be

- 4 -

issued to a Holder that delivers an Election Form with Net Exercise selected will be the number of Warrant Shares that is obtained under the following formula, rounded down to the nearest whole share:

| where |

X = the number of Warrant Shares to be issued to Holder; |

|

| Y = the number of Warrant Shares set forth under the heading Net Exercise on the Election Notice; |

||

| A = the Fair Market Value of one Warrant Share at the time of such net exercise; and |

||

| B = the Exercise Price. |

||

(f) Issuance of Warrant Shares. The Company shall, as soon as practicable thereafter and at its cost, issue and register the name of Holder the number of Warrant Shares to which Holder shall be entitled upon such exercise of the Warrant in the Register of Members of the Company and, if applicable, a check payable to Holder for any cash amounts payable as described in Section 3(d). Any exercise of this Warrant shall be deemed to have been made upon the satisfaction of all of the conditions set forth herein, and on and after such date the Person entitled to receive the Warrant Shares issuable upon such exercise shall be treated for all purposes as the record holder of such Warrant Shares.

(g) Automatic Net Exercise Upon Expiration. If this Warrant remains outstanding as of the end of the Exercise Period then, at such time, this Warrant shall, with respect to the then-vested portion of the Warrant Shares issuable hereunder, automatically and without any action taken by Holder, (i) in the event that the Fair Market Value of a Warrant Share is greater than the Exercise Price, net exercise in full into Warrant Shares in accordance with Section 3(e), or (ii) in the event that the Fair Market Value of a Warrant Share is less than or equal to the Exercise Price, immediately expire and be of no further force and effect.

4. Reservation of Shares. The Company covenants that at all times during the term this Warrant is exercisable, the Company will have reserved from its authorized and unissued share capital a sufficient number of Warrant Shares to provide for the issuance of Warrant Shares upon the exercise of this Warrant. The Company represents and warrants that it has taken all actions and has obtained all approvals and consents that are or may be necessary in order that the Company may validly issue Warrant Shares at the Exercise Price. The Company shall take all such actions as may be necessary to assure that all the Warrant Shares issued upon exercise hereof may be so issued without violation of any preemptive rights, applicable Law or governmental regulation.

5. Adjustment Provisions.

(a) Adjustment for Stock Splits and Stock Dividends. The Exercise Price and the number of Warrant Shares for which this Warrant remains exercisable shall each be proportionally adjusted to reflect any stock split (subdivision), reverse stock split (consolidation) or other similar event affecting the number of outstanding Warrant Shares.

- 5 -

(b) Conversion of Stock. Should all of the Warrant Shares be, at any time prior to exercise in full of this Warrant, exchanged or converted into shares of another class of shares of the Company (or other securities or property) in accordance with the Companys Organizational Documents, then this Warrant shall immediately become exercisable for the shares or other securities or property that would have been received by Holder if this Warrant had been exercised and the Warrant Shares received thereupon had been simultaneously converted into such other class of Company Capital Stock (or other securities or property) immediately prior to such event; provided that in the case of any such exchange or conversion, unless otherwise agreed in writing by Holder, the Warrant Shares shall be a security with voting powers, preferences and relative, participating, optional and other special rights at least as beneficial to Holder as the Companys Ordinary Shares.

(c) No Change Necessary. The form of this Warrant need not be changed because of any adjustment in the Exercise Price or in the number of Warrant Shares issuable upon its exercise.

(d) Notice. The Company shall provide notice within 10 Business Days following the date of (i) any event with respect to which an adjustment pursuant to this Section 5 is required to be made, (ii) any transfer of Company Capital Stock by the Applicable Investor and (iii) any Per Share Dividend Accrual. The Company will also provide information requested by Holder that is reasonably necessary to enable Holder to comply with Holders accounting or reporting requirements. Whenever the Exercise Price or number of Warrant Shares purchasable hereunder shall be adjusted pursuant to this Section 5, the Company shall, within three Business Days of such adjustment, deliver to Holder a certificate signed by an officer of the Company setting forth, in reasonable detail, the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated, and the Exercise Price and number of Warrant Shares purchasable hereunder after giving effect to such adjustment.

6. No Impairment. The Company will not, by amendment of its Organizational Documents, or through reorganization, consolidation, amalgamation, merger, dissolution, issue or sale of securities, sale of assets or any other voluntary action, willfully avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the Holder against impairment.

7. Company Representations and Warranties. The Company hereby represents and warrants to Holder as follows:

(a) The Company and each of its Subsidiaries is duly organized, validly existing and in good standing under the Laws of its jurisdiction of organization, and has all requisite power and authority to carry on its business as now conducted. The Company and each of its Subsidiaries is duly authorized, qualified and licensed to do business as a foreign corporation and is in good standing in all jurisdictions in which the character of the properties and assets now owned or leased by it or the nature of the business transacted by it requires it to be so licensed or qualified, except where the lack of such qualification could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(b) Exhibit B attached hereto sets forth the number and classes of the authorized share capital of the Company and the total number of issued and outstanding shares or other equity securities of the Company. All of the issued and outstanding shares of the Company are validly issued, fully paid and nonassessable. All issuances, sales and repurchases by the Company of its shares or other equity securities

- 6 -

have been effected in compliance with all applicable Laws, including, without limitation, applicable federal and state securities Laws.

(c) Except as set forth on Exhibit B, in the Bye-Laws or in the Investor Rights Agreement: (i) no shares or other equity securities of the Company are subject to, or have been issued in violation of, preemptive rights; (ii) the Company does not have (A) outstanding any stock or other securities convertible into or exchangeable for equity interests of the Company or containing profit participation features, or (B) outstanding any options, warrants or rights to subscribe for or to purchase the Companys equity securities or any securities convertible into or exchangeable for its equity securities; (iii) the Company is not subject to any obligation (contingent or otherwise) to repurchase or otherwise acquire or retire any equity securities of the Company or any warrants, options or other rights to acquire its equity securities; (iv) there are no voting agreements, voting trusts or other agreements (including, but not limited to, contractual or statutory preemptive rights or cumulative voting rights), commitments or understandings with respect to the voting or transfer of the equity securities of the Company; and (v) no Person has the right to register any equity securities of the Company.

(d) The Warrant Shares to be delivered to Holder upon exercise of this Warrant will be duly authorized, validly issued, fully paid and nonassessable, and will be delivered to Holder free and clear of any Liens or preemptive rights.

(e) The Company has the requisite power and authority to execute, deliver and perform its obligations under this Warrant and to consummate the transactions contemplated hereby. The Company has taken all action required for the execution, delivery and performance of this Warrant and the consummation of the transactions contemplated hereby, and no other action is necessary by the Company to authorize the execution, delivery and performance by the Company of this Warrant and the consummation of the transactions contemplated hereby. This Warrant has been duly executed and delivered by the Company and constitutes a legal, valid and binding obligation of the Company, enforceable in accordance with its terms, except as such enforceability may be limited by (i) bankruptcy, insolvency, reorganization, moratorium or similar Laws of general applicability affecting the enforcement of creditors rights and (ii) the application of general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at Law).

(f) The Companys execution, delivery and performance of its obligations under this Warrant (i) do not require any consent or approval of, registration or filing with, or any other action by, any Governmental Authority, except such as have been obtained or made and are in full force and effect, (ii) will not violate any applicable Law or regulation or Organizational Documents of the Company or any order of any Governmental Authority, (iii) will not violate or result in a default under any indenture, agreement or other instrument binding upon the Company or its assets, or give rise to a right thereunder to require any payment to be made by the Company, and (iv) will not result in the creation or imposition of any Lien on any asset of the Company.

8. Holder Representations and Warranties. Holder hereby represents and warrants to the Company as follows:

(a) This Warrant and the shares issuable on exercise hereof will be acquired for investment and not with a view to the sale or distribution of any part thereof in violation of applicable federal and

- 7 -

state securities Laws, and Holder has no present intention of selling or engaging in any public distribution of the same except pursuant to a registration or an exemption therefrom.

(b) Holder understands (i) that this Warrant has not been registered under the Securities Act or qualified under applicable state securities Laws based on certain exemptions from such registration or qualification that the Company is relying on, and (ii) that the Companys reliance on such exemptions from such registration and qualification is predicated in part on the representations set forth in this Section 8, including, without limitation, the representations set forth in Section 8(a).

(c) Holder recognizes that the Warrant and the shares issuable on exercise of the Warrant must be held indefinitely unless they are subsequently registered under the Securities Act or an exemption from such registration is available. Holder recognizes that the Company has no obligation to register the Warrant or the shares issuable upon exercise of the Warrant, or to comply with any exemption from such registration.

(d) Holder is aware that neither the Warrant nor the shares issuable on exercise of the Warrant may be sold pursuant to Rule 144 adopted under the Securities Act unless certain conditions are met, including, among other things, the existence of a public market for the shares, the availability of certain current public information about the Company, the resale following the required holding period under Rule 144 and the number of shares being sold during any three-month period not exceeding specified limitations. Holder is aware that the conditions for resale set forth in Rule 144 have not been satisfied and that the Company presently has no plans to satisfy these conditions in the foreseeable future.

(e) Holder has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of this investment, and has the ability to bear the economic risks of this investment.

(f) Holder is an accredited investor within the meaning of the Securities and Exchange Commission Rule 501(a) of Regulation D, as presently in effect.

(g) Holder understands and agrees that all certificates evidencing the shares to be issued to Holder may bear the following legend:

THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE ACT). THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO THE SECURITIES UNDER THE ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

9. Definitions. As used in this Warrant, (a) capitalized terms not otherwise defined herein shall have the meaning set forth in the Investor Rights Agreement and (b) the following capitalized terms have the following meanings:

Affiliate shall mean, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

- 8 -

Applicable Investor shall mean TPG VII Valhalla Holdings, L.P. and its Permitted Transferees as set forth in the Bye-Laws.

Asset Sale shall mean a sale of all or substantially all of the assets of the Company, in one or a series of related transactions.

Business Day shall mean any day other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions in New York, New York are authorized or required by law, regulation or executive order to close.

Bye-Laws shall mean the Third Amended & Restated Bye-Laws of the Company, as amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof.

Capital Stock shall mean any and all shares, interests, participations or other equivalents (however designated) of capital stock of a corporation or shares in the capital of a company, any and all equivalent ownership interests in a Person (other than a corporation) and any and all warrants, rights or options to purchase any of the foregoing.

Company shall include, in addition to the Company identified in the opening paragraph of this Warrant, any corporation, company or other entity that succeeds to the Companys obligations under this Warrant, whether by permitted assignment, by merger, amalgamation or consolidation or otherwise.

control (including, with correlative meanings, the terms controlled by and under common control with), as used with respect to any Person, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities or by contract or otherwise.

Effective Date shall mean February 8, 2021.

Fair Market Value shall mean (i) in the event of vesting under Section 2(a), the Section 2(a) Vesting Per Share Value; and (ii) in the event of vesting under Section 2(b), the Section 2(b) Vesting Per Share Value.

Governmental Authority shall mean the government of Bermuda, the United States of America, any other nation or any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government.

Holder shall mean the Person specified in the introductory paragraph of this Warrant or any Person who shall at the time be the registered holder of this Warrant.

Investor Rights Agreement shall mean the Second Amended and Restated Investor Rights Agreement, by and between the Company and each of the other parties thereto, dated February 8, 2021, as amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof.

- 9 -

IPO shall have the meaning set forth in the Bye-Laws.

Laws shall mean all United States, Bermuda and foreign federal, state or local statutes, laws, rules, regulations, ordinances, codes, policies, rules of common law and the like, now or hereafter in effect (including, without limitation, any judicial or administrative interpretations thereof, and any judicial or administrative orders, consents, decrees or judgments).

Lien shall mean, with respect to any asset, (a) any mortgage, deed of trust, lien, pledge, hypothecation, encumbrance, charge or security interest in, on or of such asset, (b) the interest of a vendor or a lessor under any conditional sale agreement, capital lease or title retention agreement (or any financing lease having substantially the same economic effect as any of the foregoing) relating to such asset and (c) in the case of securities, any purchase option, call or similar right of a third party to acquire such securities.

Marketable Securities shall mean equity securities, other than equity securities of the Company, that are listed on the New York Stock Exchange, Nasdaq Stock Market or any other globally recognized securities exchange.

Material Adverse Effect shall have the meaning set forth in the Subscription Agreement.

Ordinary Shares shall mean ordinary shares, par value US$0.01 per share, of the Company.

Organizational Documents means, with respect to any Person that is not a natural Person, such Persons certificate of incorporation or memorandum of association and bye-laws (or comparable organizational or governance documents) as amended or amended and restated from time to time and with respect to the Company, including the Investor Rights Agreement.

Person shall mean any individual, firm, corporation, partnership, trust, incorporated or unincorporated association, joint venture, joint stock company, limited liability company, or other entity of any kind.

Subscription Agreement shall mean that certain Series C Preference Share Subscription Agreement, dated as of November 5, 2020, by and among the Company, VC and each of the Subscribers named therein, as amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof.

VWAP on a trading day means the volume weighted average price per share of the Warrant Shares for such trading day on the principal market on which the Warrant Shares then trades as reported by Bloomberg Financial Markets or, if Bloomberg Financial Markets is not then reporting such prices, by a comparable reporting service of national reputation mutually selected by the Company and Holder. If VWAP cannot be calculated for the Warrant Shares on such trading day on any of the foregoing bases, then the Company shall submit such calculation to an independent investment banking firm of national reputation reasonably acceptable to Holder, and shall cause such investment banking firm to perform such determination and notify the Company and Holder of the results of determination no later than two business days from the time such calculation was submitted to it by the Company. All such determinations shall be appropriately adjusted for any stock dividend, stock split or other similar transaction during such period.

- 10 -

Warrant Shares shall mean Ordinary Shares, or such other securities for which this Warrant shall have become exercisable pursuant to Section 5(b).

10. No Shareholder Rights. This Warrant in and of itself shall not entitle Holder to any voting rights or other rights as a shareholder of the Company.

11. Miscellaneous.

(a) Assignments. No party may transfer any of its rights or obligations hereunder without the prior written consent of the other party (and any attempted assignment or transfer by any party without such consent shall be null and void). This Warrant is non-transferable by the Holder except in compliance with the terms of the Bye-Laws and the Investor Rights Agreement as relates to Holders ability to transfer Ordinary Shares. Nothing in this Warrant, express or implied, shall be construed to confer upon any Person (other than the parties hereto and their respective successors and assigns permitted hereby) any legal or equitable right, remedy or claim under or by reason of this Warrant.

(b) Amendment and Waiver. No provision of this Warrant may be waived, amended or modified except pursuant to an agreement or agreements in writing entered into by the Company and Holder.

(c) Notices. All notices and other communications hereunder shall be in writing and shall be deemed sufficiently given and served for all purposes (i) when personally delivered or given by email, (ii) one (1) business day after a writing is delivered to a national overnight courier service or (iii) three (3) business days after a writing is deposited in the United States mail, first class postage or other charges prepaid and registered, return receipt requested, in each case, addressed, (A) if to the Company, to 94 Pitts Bay Road, Pembroke HM 08, Bermuda, Attn: Leah Talactac, Email: leah.talactac@vikingcruises.com, or at such other current address as the Company shall have furnished to Holder, with a copy (which shall not constitute notice) to: Skadden, Arps, Slate, Meagher & Flom LLP, 525 University Avenue, Palo Alto, CA 94301, Attn: Gregg Noel and Amr Razzak, Email: Gregg.Noel@skadden.com and Amr.Razzak@skadden.com, and (B) if to Holder, to: Cricket Square, PO Box 2681, Grand Cayman KY1-1111, Cayman Islands, Attn: Richard Fear, Email: Richard.Fear@icloud.com, with a copy (which shall not constitute notice) to: Conyers, Dill & Pearman, Cricket Square, PO Box 2681, Grand Cayman KY1-1111, Cayman Islands, Attn: Craig Fulton, Email: craig.fulton@conyers.com, or at such other address as Holder shall have furnished to the Company in writing.

(d) Governing Law. THIS WARRANT SHALL BE GOVERNED BY, AND SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

(e) Submission to Jurisdiction. The Company hereby irrevocably and unconditionally submits, for itself and its property, to the exclusive jurisdiction of the Supreme Court of the State of New York sitting in New York County and of the United States District Court of the Southern District of New York, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Warrant or for recognition or enforcement of any judgment, and each of the parties hereto hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding may be heard and determined in such New York State or, to the extent permitted by Law, in such Federal court. Each of the parties hereto agrees that a final judgment in any such action or proceeding shall be conclusive

- 11 -

and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by Law.

(f) Waiver of Venue. The Company hereby irrevocably and unconditionally waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Warrant in any court referred to in Section 11(e). Each of the parties hereto hereby irrevocably waives, to the fullest extent permitted by Law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court.

(g) Service of Process. Each party to this Warrant irrevocably consents to service of process in the manner provided for notices in Section 11(c). Nothing in this Warrant will affect the right of any party to this Warrant to serve process in any other manner permitted by Law.

(h) WAIVER OF JURY TRIAL. EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS WARRANT OR THE TRANSACTIONS CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS WARRANT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION.

(i) Severability. Any provision of this Warrant held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

(j) Titles and Subtitles. The titles and subtitles used herein are for convenience of reference only, are not part of this Warrant and shall not affect the construction of, or be taken into consideration in interpreting, this Warrant.

(k) Counterparts; Integration; Effectiveness. This Warrant may be executed in counterparts, each of which shall constitute an original, but all of which when taken together shall constitute a single contract. This Warrant constitutes the entire contract among the parties relating to the subject matter hereof and supersedes any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. This Warrant shall become effective when it shall have been executed by Holder and when Holder shall have received counterparts hereof which, when taken together, bear the signatures hereto, and thereafter shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. Delivery of an executed counterpart of a signature page of this Warrant by telecopy shall be effective as delivery of a manually executed counterpart of this Warrant. The words execution, signed, signature, and words of like import in this Warrant shall be deemed to include electronic signatures or the keeping of records in electronic form, each of which shall be of the

- 12 -

same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable Law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state Laws based on the Uniform Electronic Transactions Act.

(Signature Page Follows)

- 13 -

The Company has caused this Warrant to be issued as of the date first written above.

| VIKING HOLDINGS LTD |

||

| By: |

/s/ Torstein Hagen |

|

| Torstein Hagen |

||

| Director |

||

| VIKING CAPITAL LIMITED |

||

| By: |

/s/ Richard Fear |

|

| Richard Fear |

||

| Director |

||

[Signature Page to Warrant]

EXHIBIT A

WARRANT EXERCISE ELECTION NOTICE

To: Viking Holdings Ltd

We refer to that certain Warrant to Purchase Ordinary Shares of Viking Holdings Ltd, Warrant #OS-2, issued on February 8, 2021 (the Warrant). Capitalized terms used but not defined herein have the meanings ascribed to them in the Warrant.

Select one of the following two alternatives:

☐ Cash Exercise. On the terms and conditions set forth in the Warrant, the undersigned hereby elects to purchase ____________ Warrant Shares pursuant to the terms of the Warrant, and tenders herewith payment of the purchase price for such shares in full.

☐ Net Exercise. On the terms and conditions set forth in the Warrant, the undersigned hereby elects to exercise ____________ Warrant Shares by net exercise election pursuant to Section 3(e) of the Warrant.

Please issue a certificate or certificates representing such Warrant Shares in the name of the undersigned.

WHEREFORE, the undersigned has executed and delivered the Warrant and this Warrant Exercise Election Notice as of the date set forth below.

| Date: |

[HOLDER] |

|||||

| By: |

|

|||||

| Name: |

|

|||||

| Title: |

|

|||||

[Signature Page to Warrant Exercise Election Form]

EXHIBIT B

CAPITALIZATION